How Diversity Drives Impact, Returns, Reflection and Improvement

Today’s classrooms forecast tomorrow’s demographics, and the U.S. is becoming more diverse by the year. In 2018, children from non-white racial and ethnic minority groups made up 53 percent of all public K-12 students, a figure that is projected to increase throughout this decade.

As former teachers and current education technology investors, we believe the greatest impact will be driven by companies that expand access to education and economic mobility for everyone. And we believe that those building and funding these efforts should reflect the diversity of the communities they serve. Founders who best understand their users and their needs are often those who have lived through shared experiences.

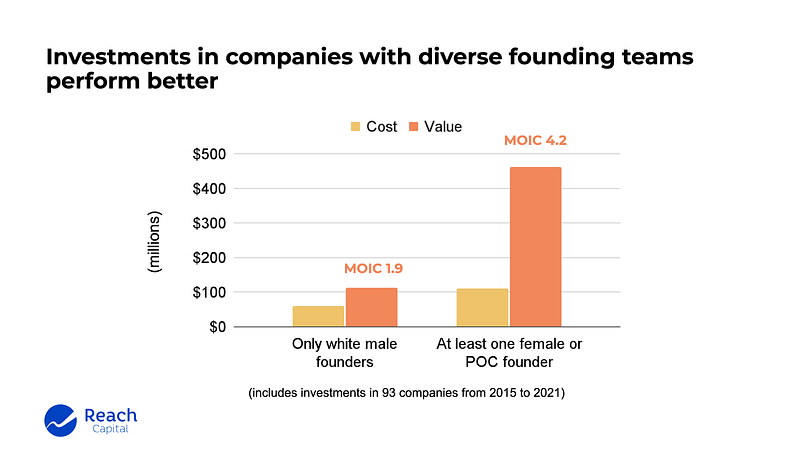

Investing in diverse founders isn’t just a moral imperative or DEI initiative du jour. It also makes business sense. Startups with at least one female co-founder generate more revenue than those without, and companies with at least one non-white co-founder return 30 percent more cash to investors when they go public or are acquired than teams with all white founders.

Likewise, in our portfolio, companies with diverse founding teams perform better than those with only white male founders. Companies with diverse founding teams represent 64% of our cost basis but 80% of value in our portfolio.

At Reach Capital, we have intentionally built a diverse investment team. When it comes to reaching all learners, how we measure our impact is shaped by how we measure diversity — and vice versa. For us, this is an important and ongoing journey.

Phase I (2015–2019)

When we started Reach in 2015, we categorized the diversity of founders in our portfolio by gender, people of color (defined generally as non-white), and people of color from underrepresented backgrounds (Black or Latinx/Hispanic). As we shared in a 2017 post:

- 22 percent of our companies at the time had a female founder,

- 41 percent had a founder of color, and

- 15 percent had an underrepresented founder of color (Black or Latinx).

While we were far short of our goals, these figures exceeded venture industry averages at the time.

After our first analysis, we gradually updated our data systems, so diversity metrics could be more integral to our daily work. We created an onboarding survey for founders and asked them the race/ethnicities and gender with which they identified. We added new fields to our CRM to capture diversity data of pipeline companies as we screened them.

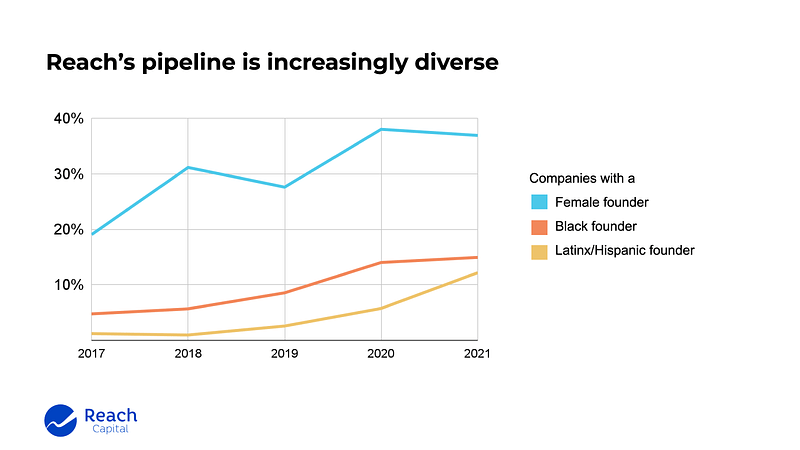

In addition, the team put considerable effort into sourcing and growing our pipeline of founders from underrepresented backgrounds. Several Reach partners were active founding members of AllRaise, a non-profit organization focused on increasing the number of female investors and early-stage founders. We also established and deepened relationships with organizations such as BLCK VC, Latinx VC, Founder Gym and Camelback Ventures that support and invest in female, Black and Latinx/Hispanic founders. We nurtured relationships with like-minded co-investors such as Kapor Capital, Rethink Education and Rethink Impact to share dealflow opportunities. Efforts paid off, and we continue to see increased diversity in our pipeline.

Phase 2 (2020–2021)

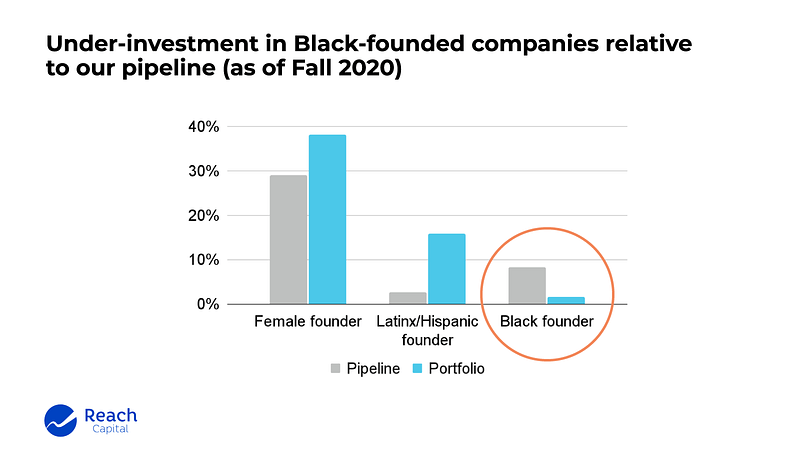

Over the summer of 2020, in the aftermath of the murder of George Floyd, we realized that our “underrepresented minority” category was too blunt and that we needed to disaggregate our data by race. The more precise look at our data forced us to face a stark reality: In five years of investing in 63 companies, we had only invested in one company with a Black founder.

An obvious culprit might be a weak pipeline. However, armed with pipeline data also disaggregated by race, we realized there was something deeper going on. While our pipeline was relatively strong, we had funded very few companies with Black founders.

This led us to reflect deeply about the possible biases that influenced our decision-making processes. More details are captured in a case study recently published by the Stanford Graduate School of Business, which chronicles our efforts to better understand and redress bias in our work.

Reflecting on questions posed in the case study and others spurred changes throughout our investment process:

Sourcing. We doubled down on relationships with funds and networks that specifically support underrepresented entrepreneurs. We have explicit relationship owners who regularly touch base with these groups. We are also analyzing the diversity of our pipeline by team member to provide more actionable data for individuals.

Investment strategy. We focused our “Lab” pool of capital toward pre-seed investments. While this is not explicitly earmarked for underrepresented founders, it has led to more early-stage investments in them. Of the 41 Lab investments we’ve made, 46% are in companies with a female founder, 7% in companies with a Black founder and 27% in companies with a Latinx/Hispanic founder.

Screening. We’ve added guardrails to protect against potential biases in decision-making. To avoid rushed turn-down decisions, we do deeper prep work before founder meetings, extend meeting times to get to know the founding team, and have multiple teammates review pitch decks or meet Black or underrepresented founders before making a decision. The investment team also participated in a bias reduction training by Illumen Capital, a new LP in our fund. Illumen’s “equity primer tool” helps the team pause before and after a meeting to name and identify biases.

At the same time, today’s competitive investment environment often demands fast decision-making, and we’ve had to hustle to make quick decisions and win deals. This tension has pushed us to acknowledge risks that we are willing to take for repeat founders or those with elite credentials that we may not be willing to take for founders from an underrepresented group without a similar pedigree.

Data collection. We continue to refine our data collection for turn-down reasons to be even more precise and to glean insights about why we disproportionately turn down certain founders. Previous reasons like “product-market fit” and “market” were too broad to provide actionable feedback. We created more specific subcategories, such as “weak engagement” and “slow growth,” for concerns around product-market fit, and “too small” and “no unfair advantage” for concerns about the market.

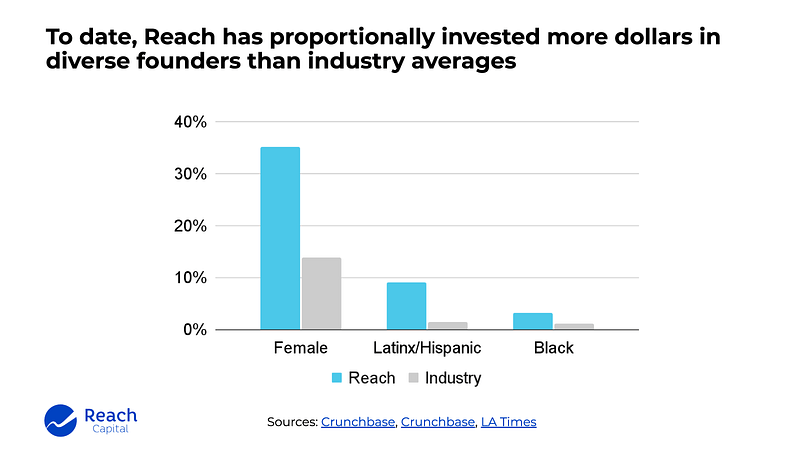

While these changes are new, they’ve already begun to bear fruit. In our most recent Reach fund (Reach III), the proportion of our dollars invested in female, Latinx/Hispanic, and Black founders has increased compared to our prior fund. Today, our overall portfolio has a higher percentage of companies with female founders (36%), Latinx/Hispanic founders (16%) and Black founders (4%). These numbers correlate roughly with the percentage of our invested capital that has gone to female founders (35%), Latinx/Hispanic founders (9%) and Black founders (3%).

As a benchmark — albeit one that is a disappointingly low-bar — Black and Latinx/Hispanic founders received just 1.2 percent and 1.5 percent, respectively, of all U.S. venture capital raised through the first half of 2021. Through August 2021, companies with female founders received just 13.9 percent of all venture funding raised.

Our Journey Continues: More Data, More Questions

Our journey continues. While Reach is among the top seed investors in companies with female founders and underrepresented minority founders, there is still a ways to go before our overall portfolio diversity is representative of the U.S. population.

As we continue to refine our data collection to gain more insights that inform our processes and decision-making, some big questions have emerged:

- How does the definition of diversity change when a firm (such as Reach) invests in non-U.S. markets?

- Should we expand our analysis beyond founders to the diversity of the team and its users served?

- Is it the responsibility of a “diverse” (i.e. non-white) investment team member to bring more diverse pipeline?

This is an ongoing journey and we are committed to sharing our learnings along the way to spur ideas, reflections and, most importantly, action. Our hope is that venture capital is more accessible to those who have been left out of a high-growth financial sector that wields great influence on wealth creation.

We welcome your ideas, feedback and suggestions! Feel free to reach out and share them with jenwu@reachcapital.com.