About us

Our Commitment to You

Since 2015, we’ve backed hundreds of visionary entrepreneurs building technologies that expand access to opportunity and care.

Our belief is that when people are equipped to grow their skills, nurture relationships, be healthy, and find meaning in what they do, communities thrive.

The Reach Craft to

Early-Stage Investing

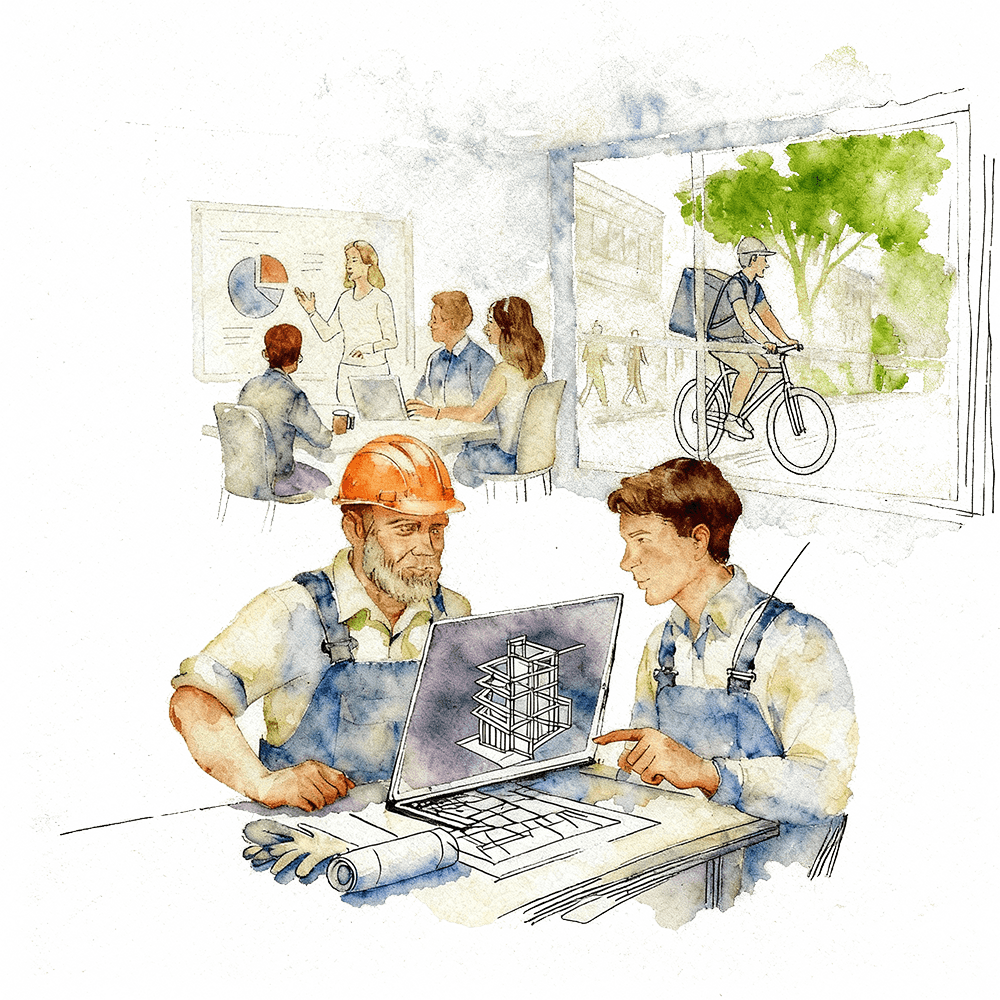

Early-stage investing is as much art as science, and strong relationships are at the core of our work.

While we’re investors first and foremost, our diverse backgrounds as former founders, operators, educators, designers, and writers bring a distinctly “liberal arts” approach to supporting founders more comprehensively and creatively. Our team works to help them transform the first sketches of ideas into fully-realized, world-changing impact.

Focus areas

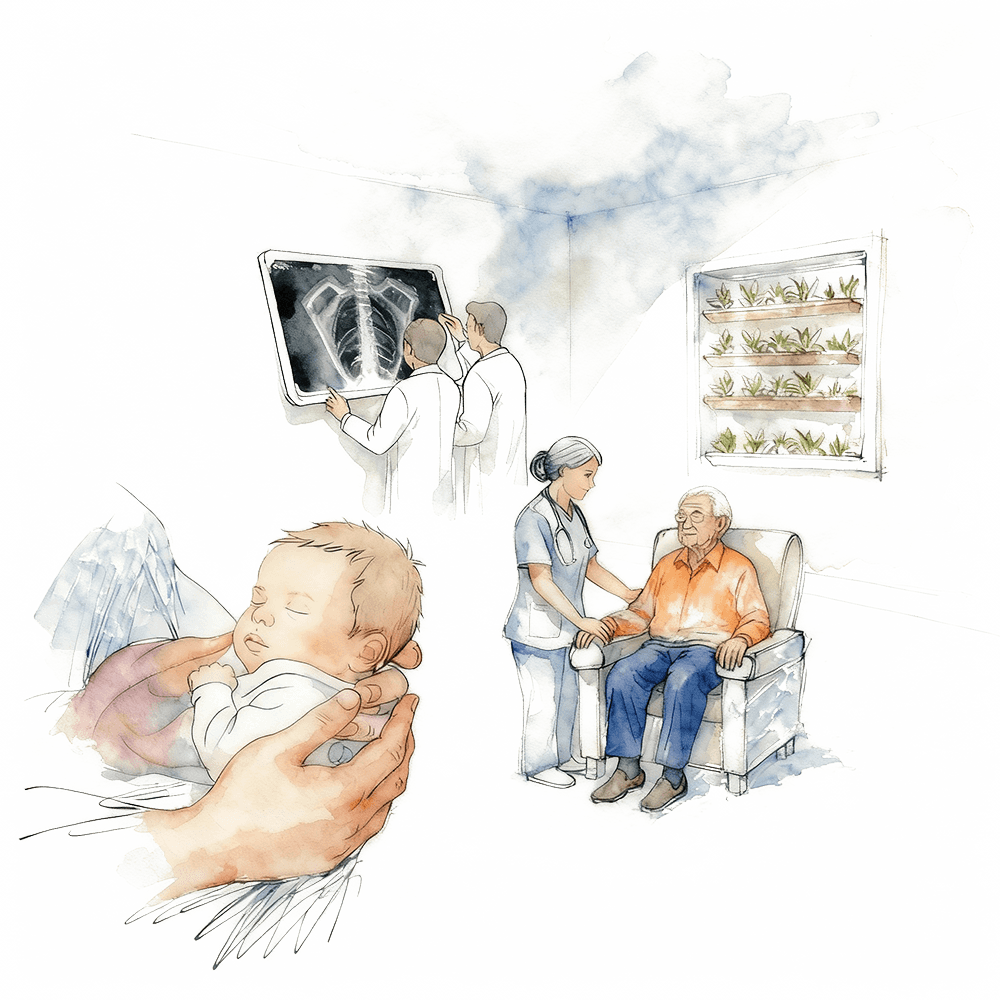

Where We Invest

Our team

When We Invest, We Are All In For You

At Reach Capital, we are dedicated to fostering a future where everyone can live, learn and thrive. We’re proud and honored to back mission-driven companies that elevate human potential and ignite purpose across learning, health, and work. Our diverse backgrounds and deep operational expertise enable us to help founders at every stage of growth.

Our values

The Reach Way

Alignment on our values drives our team, our investments, and our commitment to our founders. We intentionally blend skills, backgrounds, and perspectives, and place a premium on egoless team players who elevate others.

FAQ

For Founders, Friends, and the Curious

What’s the history behind Reach Capital?

Reach Capital has its origins in NewSchools Venture Fund (NSVF), where our founding partners began working together and investing in early-stage education technology companies when they launched the NewSchools Seed fund in 2011 and the Zynga co.lab accelerator. The team made over 40 early-stage investments through that fund, including K-12 category leaders such as Newsela, Nearpod (acquired), SchoolMint (acquired), NoRedInk, ClassDojo, and Ellevation (acquired).

To grow their impact and continue investing in companies transforming how people learn, grow, and thrive, they spun out of NSVF and founded Reach Capital in 2015. They picked the name Reach to signify the goal of expanding the reach of high-quality learning experiences that increase access to opportunity. Reach has since invested in over 140 companies across learning, health, and work—areas that are essential and interconnected in our mission to enable people to live their best lives.

What stages do we invest in?

We are an early-stage venture capital firm that typically makes initial investments in Pre-seed, Seed, and Series A rounds.

What is our investment timeline?

A key element of our investment strategy is our ability to make investment decisions in a timely and efficient manner. We apply a high standard of due diligence when evaluating potential investments, but are nimble and can move quickly when necessary.

How much do we typically invest?

Our check size depends on the stage of the financing round and the company’s business model. It typically ranges from $100K for Pre-seed to upwards of $12 million for later-stage startups.

How can you get in touch with us?

- Need marketing collateral? Find our media kit here.

- Have general questions about early-stage venture capital financing? Email us here.

- Want to know what’s happening at Reach? Subscribe to our newsletter here.

How can I find a job at a Reach portfolio company?

Check out openings at our portfolio companies here.

We also have a jobs community for early-stage technical talent here.