In Part I of our healthcare series, we reviewed the nine trends that are transforming health care. One of the biggest challenges is the pervasive workforce shortage across the globe. The U.S. alone will face a shortage of 3.2 million healthcare workers by 2026 across a range of fields, from medical assistants and home health care aids to registered nurses and physicians. This is particularly problematic as demand for care continues to grow with an aging population and an increase in chronic conditions.

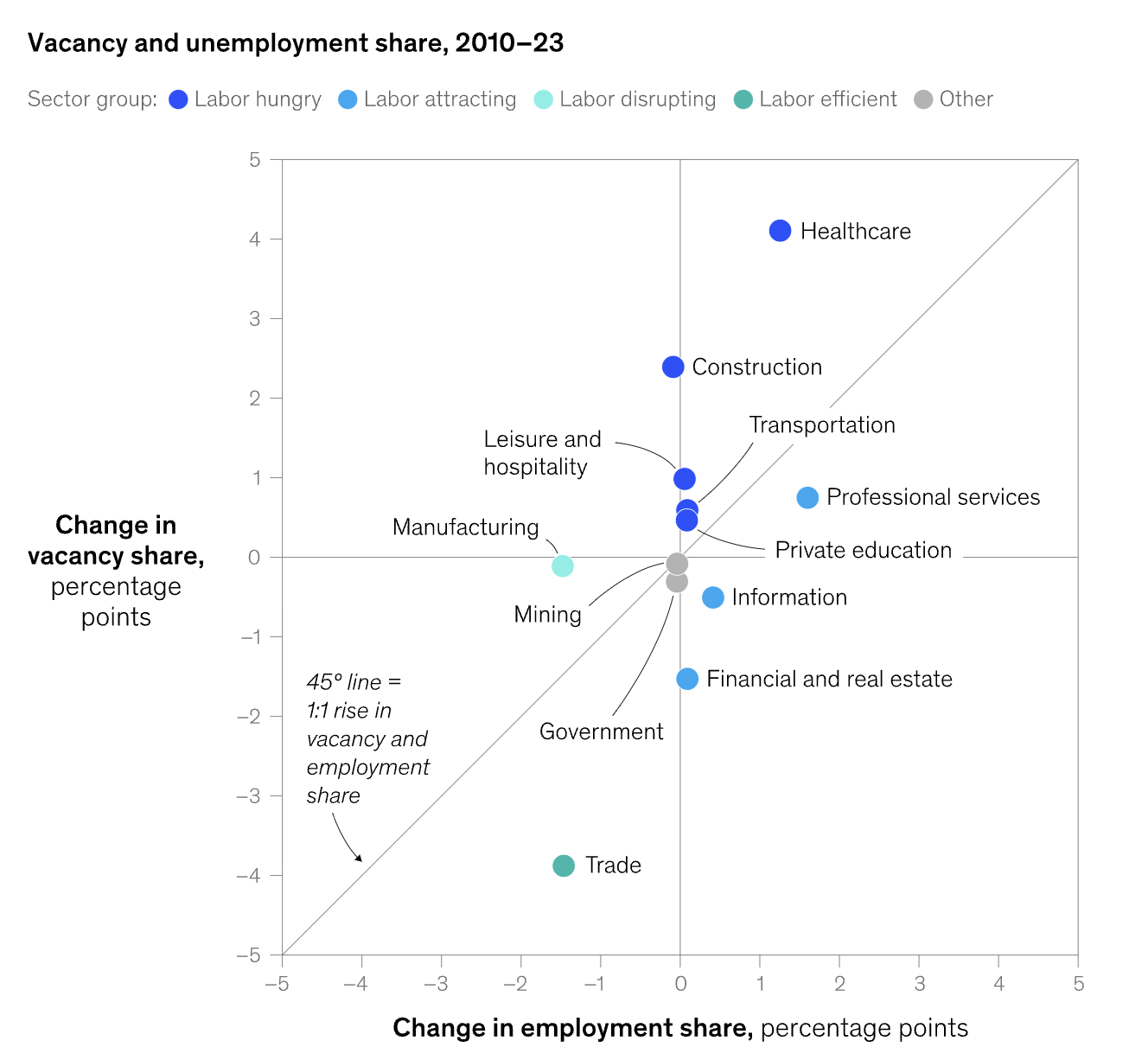

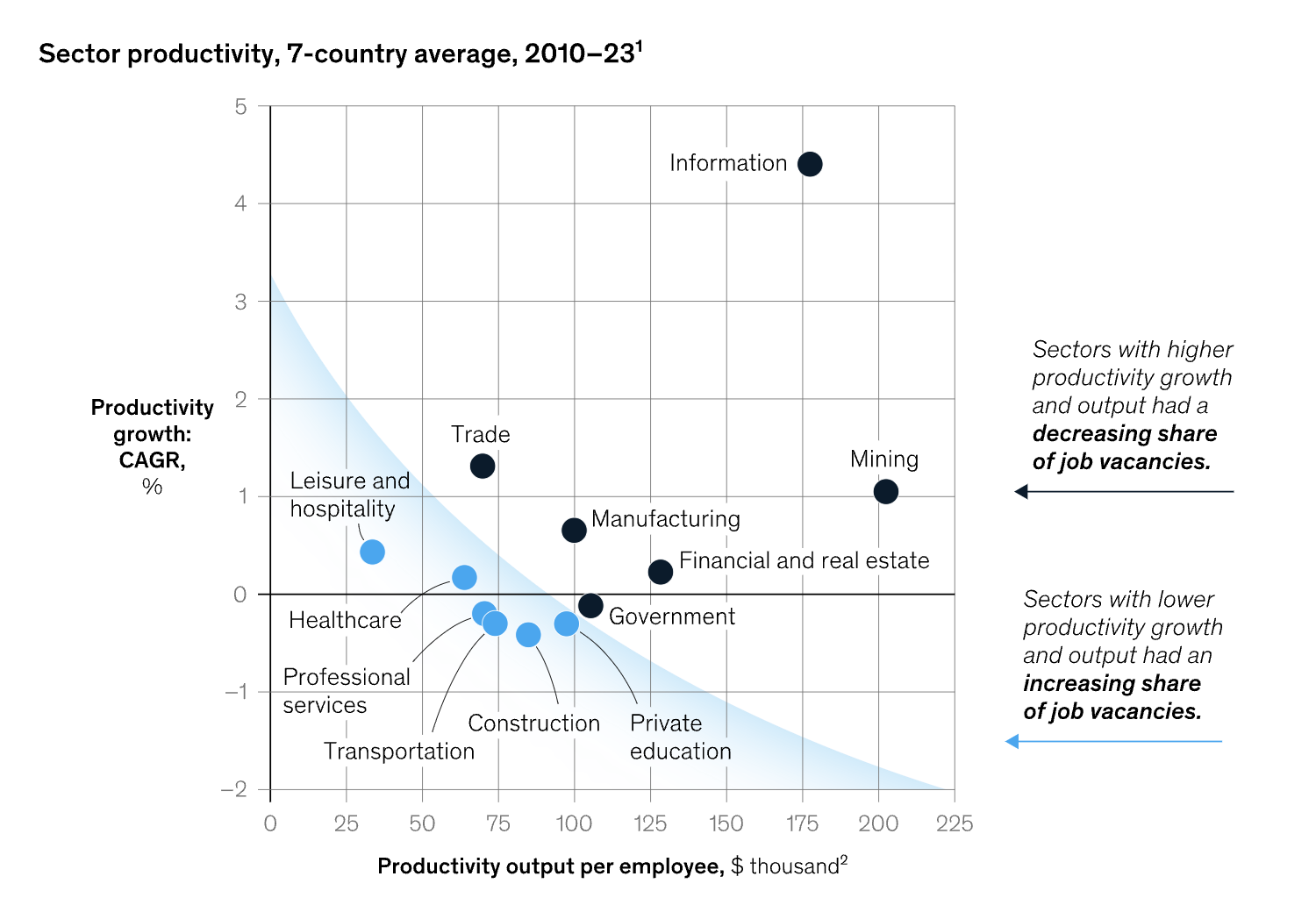

As shown below from a recent McKinsey analysis, the healthcare industry has the greatest demand for new workers as well as significant room for productivity improvements. Labor costs, on average, make up over 50% of a hospital’s expenses and they are only rising.

As we looked at the market for solutions addressing this workforce shortage, we mapped out the career journey of a clinician within the context of a health facility (as opposed to a business-in-a-box platform). We identified five key areas where there are gaps and inefficiencies that present opportunities for outsized impact.

- Training: The process of getting trained and earning the appropriate credential to work can range from a medical assistant course that takes a few months to complete, to a MD program that takes many years. For many, access to training can be difficult because of the cost, amount of time required, and lack of available spots. Stepful and Aprende (both Reach portfolio companies) address this category by providing fast, affordable, and effective methods of training for the allied healthcare workforce.

- Recruitment and Placement: Given the labor shortage, finding talent is increasingly difficult for healthcare employers. Many rely on staffing agencies that charge upwards of 40% of a successful hire’s salary. Many qualified candidates also struggle to find their best-fit employer based on criteria they care about, like flexibility, patient load, and work culture. Companies like Guild, Aprende and Stepful are helping employers build their own talent pipelines while marketplaces like Nomad, Trusted, Pickle, and Incredible Health are helping to connect labor supply with demand.

- Workforce Management: Workforce management encompasses a range of administrative and HR work, including onboarding, scheduling, and retaining staff. Some of these processes like credentialing can be cumbersome, sometimes delaying a clinician’s start date by months. Most large hospital systems work with legacy incumbents like Workday and Oracle but these platforms increasingly do not reflect the complexity of delivering care today. New players like Arya are re-thinking the full workforce management suite for health care from the ground up. Players like Planbase are starting with improved scheduling with plans to expand more broadly across workforce management.

- Upskilling and Recertification: Most clinicians are required to engage in continuing education to keep their license up to date. Many employers also provide upskilling opportunities for their employees. This pace of learning is critical in a field where medical knowledge is doubling every 73 days. Players like Assemble (coaching for nurses), Colibri (medical CMEs), and Reflex (healthcare focused simulation training) fall into this category.

- Augmentation: These are tools and supports that support clinicians within the flow of their work to boost their individual productivity. This is where we see a lot of room to ameliorate the impact of the current workforce shortage, as we work to solve the broader labor supply problem for the long term. There has been an explosion of clinical productivity tools, largely starting with scribing technologies such as automating note taking and charting. But there are other immense opportunities especially in specific specialties, such as Aster (AI-driven EHR focused on women’s health), SST (which uses computer vision to enhance clinical effectiveness in the operating room), and Alpaca (which leverages computer vision to help ABA therapists in their work).

In the market map below, we highlighted key players in each of these categories.

While this market map is not exhaustive, it should illustrate the explosion of activity happening in the sector. There are a few areas that we are particularly excited to dive into.

Modern workforce management tools specialized for healthcare

With increasing demand for worker flexibility, the rise of cross-state licensing, new modalities of care (at home and virtual), and labor supply challenges, existing workforce management tools have struggled to adapt to evolving healthcare workforce needs. For example, 57% of healthcare leaders report that time and attendance processes remain manual, resulting in data discrepancies that require additional manual work.

We are interested in companies that are building a modern workforce management platform focused on meeting the needs of clinicians and employers today. These tools will likely offer more flexible scheduling options, help to streamline the credentialing process, address retention, and more. One interesting initial wedge is improved scheduling, given how acute the pain point is for both employers and workers.

The new “UpToDate”

With medical knowledge now doubling every 73 days, it is not surprising that 70% physicians report feeling overwhelmed by the amount of information available. In fact, a new medical article now appears every 26 seconds. We believe there is a need for a new UpToDate (currently the leading medical reference tool used by clinicians to get the latest clinical and drug information) for the modern provider and which accounts for the increasing complexity in care.

Given the strong penetration of medical knowledge tools like UpToDate and Epocrates, there may be interesting wedges in specialties that have the greatest number of studies to track (like oncology, cardiology, and neurology) or in areas where care is complex and timely access to trustworthy answers is critical (such as in an emergency room). With our deep understanding of how technology can help people learn, we have a unique point of view on the ingredients of effective tools in this space. Early research has indicated that surprisingly physicians do not perform better in diagnosing diseases when they have access to general AI tools like ChatGPT, due to overconfidence in their own skill sets and not really knowing how to properly leverage these tools. That’s why it’s critical that these products are built with a strong foundation of how adults learn and process information best.

Such a tool may not look or feel like UpToDate in its current form — it may be social, multi-player, multi-modal, etc. — but it will be essential in helping clinicians answer critical questions within the flow of their work.

Specialized workflow and augmentation tools

Many health specialties need specific software that augments the clinician in the flow of their work. While there has been an explosion in horizontal tools that help with scribing and other administrative functions, the number of AI-native companies focused on targeted specialties is more constrained.

We are especially interested in tooling focused on up-and-coming specialities (e.g. longevity), highly verticalized and underserved fields (e.g. fertility and women’s health), and very complex and collaborative treatments (e.g. oncology and endocrinology). The companies that will succeed here will leverage technology in ways that are highly unique to that specific domain and would be difficult for horizontal players to replicate (such as leveraging computer vision to enhance effectiveness in the operating room, which is a highly visual workflow requiring multi-modal technology). We have a long history of scaling impactful solutions that help people learn in the flow of their work.

While this analysis focused on the journey of a clinician within a health system, we are excited about other areas in health care, such as direct-to-consumer delivery models that enable more personalized and holistic care, self-empowerment platforms that help clinicians build their own businesses, back-office tooling that help clinicians focus on clinical work instead of administrative tasks, and more. Stay tuned as we continue to dive into other areas of health care with outsized potential to elevate human potential and ignite purpose.

If you are building a company that is focused on transforming health care, please reach out to jomayra@reachcapital.com or submit your company’s information here!