Reflecting on Our Impact on K-12 Since 2015

Reach was founded on the belief that technology can meaningfully extend access to education and opportunity. It can be a powerful tool for equity but it has its limits, partly because of the social — and sometimes serendipitous — nature of learning. This tension has guided our investment approach and led us to carefully identify specific areas where technology can make a difference.

Back in 2015, we developed investment theses in the following 4 areas:

- family communication (strengthening the connection between the parent, teacher and student)

- differentiating instruction (facilitating personalized learning)

- relevant learning experiences (connecting learning to personal interests and the real world)

- data-driven improvement (bringing data to all level of decision-making)

We made 28 core investments aligned to those theses and worked closely alongside the founders helping them scale their businesses.

Now, after seven years and a ground-shifting global pandemic, we’re taking a step back to reflect on what we got right, what we didn’t expect, and how we can be more effective going forward.

This K-12 Impact Report is our first attempt to examine the collective influence that our portfolio has had on the K-12 education sector. (Forthcoming reports will look at our work in early childhood, higher education and workforce.) From humble beginnings, many of the tools our founders have built are now beloved brands, widely used in schools and homes across the world.

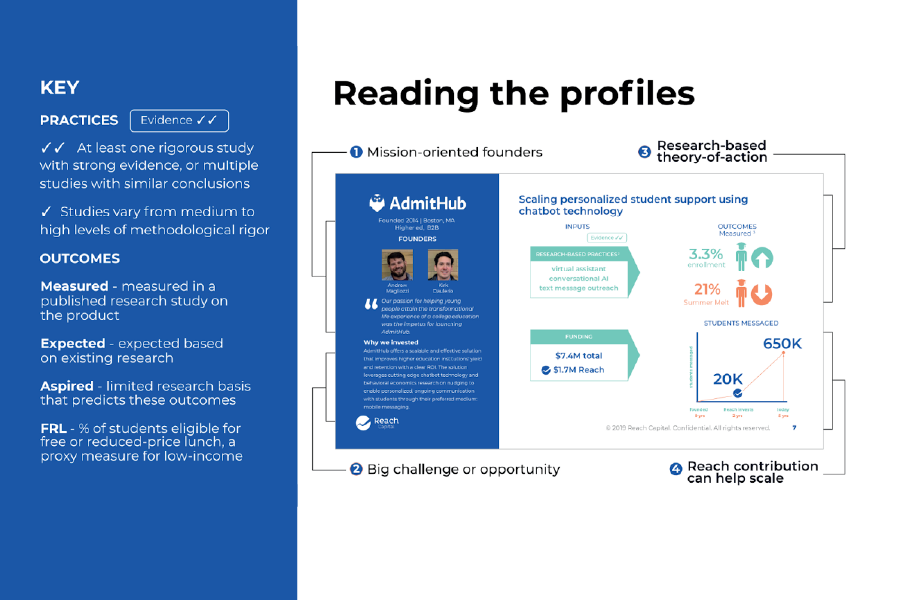

This report is an evolution of our impact reporting efforts. It builds on earlier work to understand what populations our portfolio serves and the impact that individual companies have. It also applies our impact framework and metrics we use to screen prospective companies seeking funding, and to support them post-investment. It provides an inside look at how Reach thinks about impact, how we do our work, and how we share learnings across the portfolio.