In the fall of last year, I announced my jump into web3. Since that article, our research associate John White and I have done a lot to better understand the ecosystem. We talked to folks investing in web3 before it was cool along with newcomers like us, participated in NFT projects like Crypto Coven, joined learning DAOs like Crypto, Culture, and Society, invested in companies that are transitioning to web3 to better support their communities like SuperHi, and have invested in crypto-native companies that have yet to be announced.

We learned a lot and are thrilled to share more about where Reach is actively looking for opportunities.

First, how do we segment the market?

Reach has always been committed to investing in companies that help people reach their full potential. To that end, we typically invest in two levers: companies that improve 1) education and 2) economic mobility. While there is endless opportunity across the web3 ecosystem, we are really focused on finding those that leverage web3 technologies in the areas we understand best.

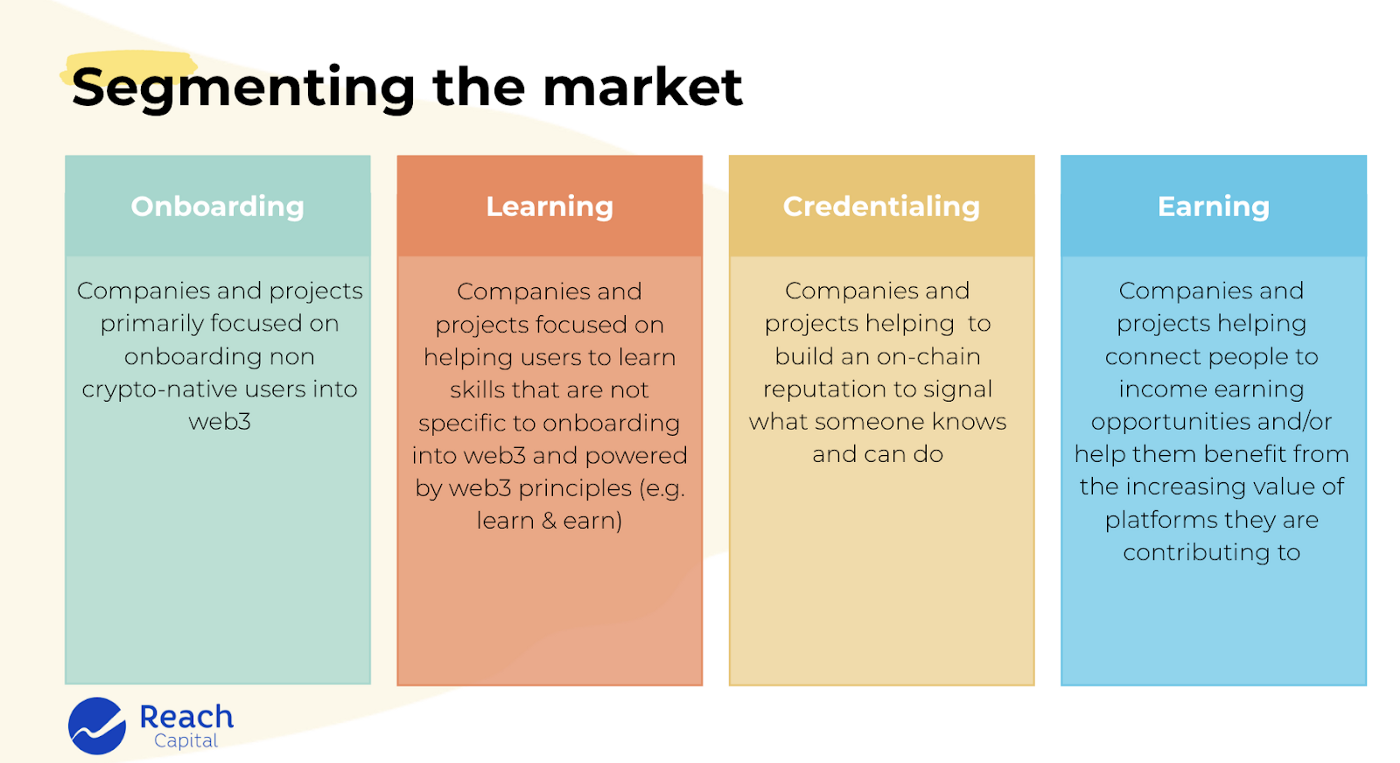

We segment our relevant market into four categories: onboarding, learning, credentialing, and earning. You can see explanations for each of those categories below. We believe there is value to be created within each of these — and, in many cases, there are companies that operate within more than one of these areas.

What did we learn?

There is a lot of activity happening across the categories.

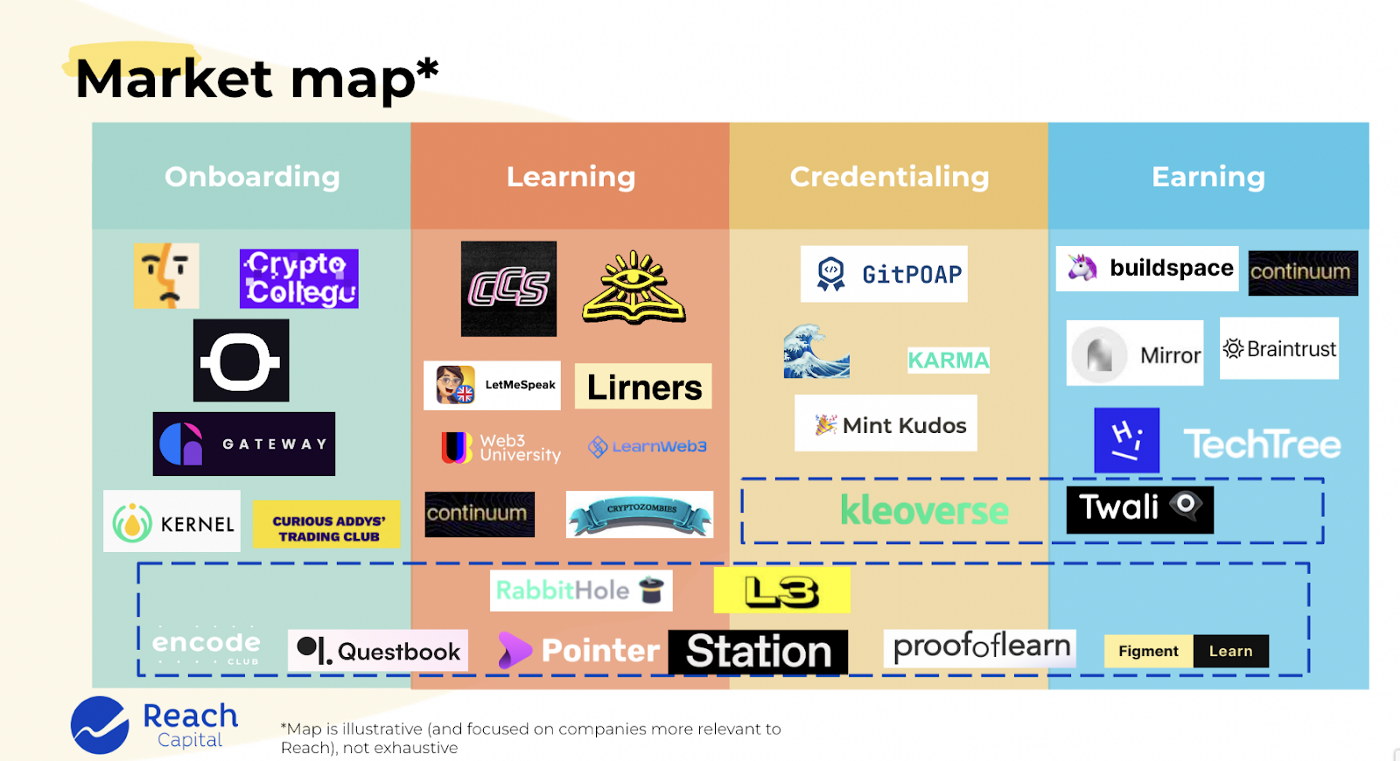

As shown in the illustrative market map below, there are companies already operating in each of the categories — many of them less than a year old. (By the way, if you’re on this list and don’t agree with how you’re categorized, please reach out!) This doesn’t even represent half of the companies we’ve come across over the last few months or the web2 companies that are considering a web3 transition.

The learning X web3 venture-backable market is early, and “learning” sadly seems to come second to “web3.”

We are excited about the opportunity for the next generation of learning companies to leverage web3 technology in relevant and transformational ways. That said, in terms of finding viable and scalable business models, it doesn’t seem like companies have yet found their stride. The use cases and business models are still nascent, which is just a reflection of how early the sector is.

One of the more prominent business models we’ve seen is “learn-to-earn,” which allows users to complete crypto-specific actions (e.g. create a Metamask wallet) and receive crypto rewards from the project/protocol (in this case it would be Metamask). The middle-man company would then take a cut of that reward, which resembles other lead-gen models (e.g. Credit Karma). We’ve also seen some learning DAOs that have started to launch revenue-generating activities (e.g. creating learning content for other DAOs). None of these have hit a meaningful scale yet, but we are watching closely to see how they evolve.

Moreover, of those companies that are offering learning opportunities, we have found that few are leveraging some of the best practices that we know work when it comes to high-quality pedagogy and curriculum — an area our team of former educators are experts in. They seem to be primarily focused on getting the web3 component to work first, and treat the learning as a secondary component. But we are excited to see that switch as the ecosystem grows and a range of talent (including instructional designers) joins.

The earning X web3 venture backable market is a bit further along (albeit in an overall young market).

We have been encouraged by the activity in the “earning” part of the sector. Whether it’s connecting devs to web3 opportunities (e.g. Buildspace), operating a freelancer marketplace (e.g. Braintrust), or helping creators monetize and own their work product (e.g. Mirror), there are many viable business models with real momentum in the earning part of this ecosystem. While the overall ecosystem is early, we’ve found there to be some of the most acute pain points and market readiness within this category.

For example, in a web2 world the biggest winners in the creator economy were not the creators themselves — they were Youtube, Instagram, Twitter, TikTok, etc. In a web3 world, we are seeing platforms provide avenues for creators to own parts of the network and benefit from accruing value to the overall platform. This is an acute pain point and participants (in this case creators) are open and ready to try new solutions.

Many are operating across categories.

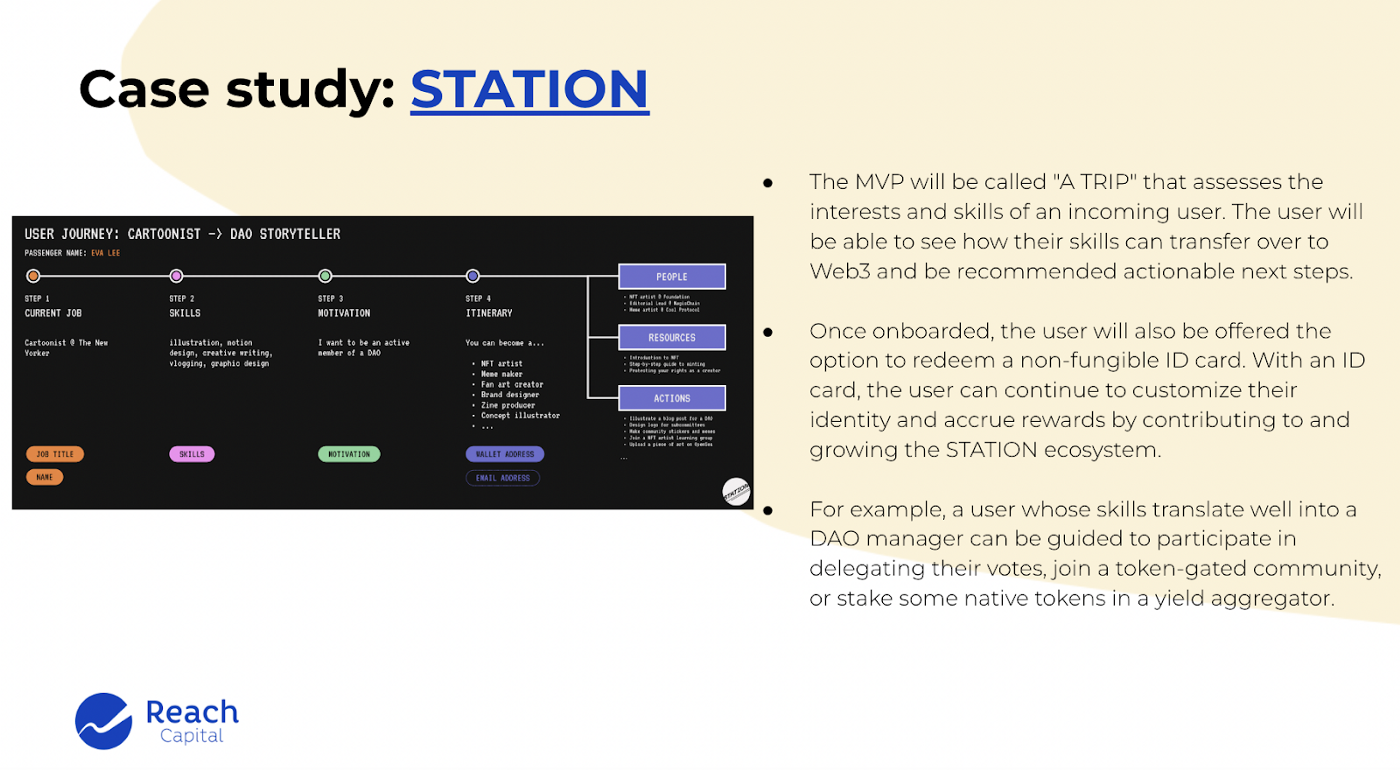

We’ve seen many companies attempt to traverse the categories and take more of a platform approach. For example, Station is helping people onboard to web3 by helping them understand how their current skills and preferences translate into web3 roles. Based on the assessment, the company plans to offer relevant educational content and connect them to the right projects and roles. We imagine this will continue to increase as companies start to evolve and want to support users across the learn-and-earn ecosystem.

The market still requires a steep learning curve for users, so we developed a viability framework.

Relative to the 5 billion global internet users, the adoption of crypto (~300M users) is still pretty small. Given that, we have started to assess companies in this space across three attributes:

- Is their target user a likely early adopter?

- Is the acute pain point high enough with current solutions?

- Is there an existing web2 viable business model that can be implemented?

All of the answers do not have to be yes, but they do provide us more clarity on the realistic 12–24 month growth expectations for the company. For example, as we think about web3 freelancer marketplaces, our assessment would be:

- freelancers tend to be more digitally native and early adopters;

- current solutions have high take rates and are sub-optimal;

- there is a very viable business model that exists so there is likely a viable growth path for this company in the short term.

There is a glaring lack of diversity in web3 founders.

We care deeply about diversity at Reach — both internally and in the teams we invest in. We think it’s critical for the next generation of the internet to be built by a much more diverse set of founders than that of web2.

We are in the early innings of web3, but we still have been disappointed by the relative lack of women and people of color who are founders in the category. We are really hoping to find more diverse teams as we continue to dive deeper — and are committed to doing what we need to find and fund these founders.

What is Reach excited about?

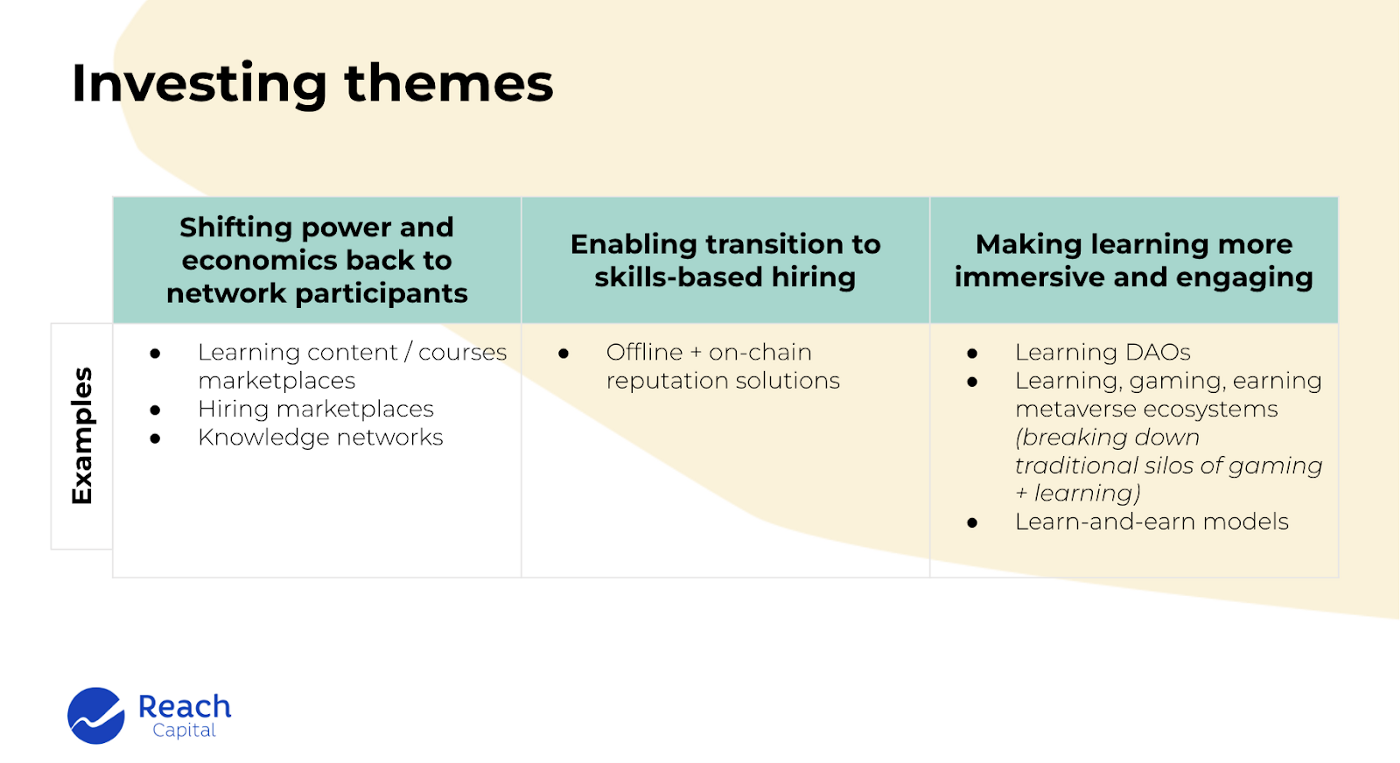

Within our areas of focus, we have identified three primary themes that we are hoping to invest in.

1. Shifting power and economics back to network participants.

One of the primary tenants of web3 is ownership: shared financial ownership of a platform, ownership of your own data and work, and ownership over governance (i.e. how the platform evolves over time, rules, etc.). In web2, the biggest winners were not the users (customers and workers) of Uber, Doordash, or Fiverr; they were the owners of the underlying platform. In a web3 world, those wins get distributed to all network participants. Within this category, we are looking for hiring marketplaces (e.g. Braintrust), knowledge networks (e.g. Twali), and learning marketplaces (e.g. SuperHi).

2. Enabling the transition to skill-based hiring.

As I mentioned in the first article, the area where I think we could accomplish something in web3 that we weren’t really able to do effectively in web2 is truly shifting hiring to be skills-based, versus based on pedigree or degree. The wonderful aspect of the blockchain is that it captures every action you complete online. These crypto-native actions and contributions can roll up to offer a better picture of what someone is able to do, as opposed to a static diploma or badge.

To be clear, there is still a lot that cannot be captured on-chain (e.g. interpersonal skills), but we’ve started to see some interesting work-arounds. For example, Mint Kudos allows community members and leaders to provide “kudos” as a non-transferable token (NTT) to different members. This allows there to be a higher degree of personalization of peer feedback in a method that can’t be transferred to anyone else.

3. Making learning more immersive and engaging.

We are interested in companies that leverage web3 to make education materially better. An area we’ve been exploring is how the traditional silos of gaming and learning can be finally broken down in a web3 world by creating a metaverse where gaming, learning, and earning come together in transformational ways. Companies like AAG are exploring the learning-gaming-and-earning opportunity as illustrated in their whitepaper. We are also excited to continue to dive into learning DAOs and see if they can rival traditional learning organizations.

Does that mean Reach is investing in Web3?

YES (and we already have)! We even have current companies that are playing an important role in the web3 ecosystem — for example, Replit allows its users to learn solidity and create dApps in accessible and collaborative ways through its platform.

We are excited to be the education and workforce domain expert partner to complement a value-add crypto-first fund. We know that web3 founders have more options for capital than ever before, and it’s important to curate a set of investors that reflect the desires of the communities they are serving. We aim to be flexible and work closely with founders to create a partnership they would be excited about.

If you are building in any of the categories we mentioned or just want to jam with us as we continue to learn, email me at jomayra@reachcapital.com!

Special thank you to John White (our web3 research associate), Ethan Beard (resident Reach family web3 expert), and Steve McDermid (one of the few amazing people willing to read through a 90 slide deck and offer feedback)