US Edtech’s Roaring Twenties Begins With $8.2 Billion Invested in 2021

by Tony Wan, Head of Investor Content

A rising tide of capital swept through every industry last year, and education technology was no exception. Buoyed by ongoing digital transformations in how we live, learn and work, U.S. education technology companies raised $8.2 billion of investment capital in 2021, according to our analysis of deal data from Pitchbook and Crunchbase.

This is the largest sum of venture capital the U.S. edtech industry has ever seen — nearly four times the $2.2 billion total raised in 2020.

To be fair, everybody got a boost. At $8.2 billion, the edtech industry accounted for 2.5 percent of the record $330 billion raised by all U.S. venture-backed companies last year. That may seem like a tiny sliver. But considering that edtech funding accounted for just 1 percent of overall capital invested in previous years, this is a notable step up for a sector that many venture capitalists once hesitated to venture into.

Note: What constitutes “edtech” is broad, as the lines separating education from parenting, productivity, health and other adjacent sectors are increasingly blurred. Name a job, skill or hobby, or ask any question, and chances are there is a company or course dedicated to it. Our sweep of the data surfaced training startups for personal fitness, firearms, bartending and hair salons, among many others. (My favorite: a “remote sleep school” for babies.)

Accounting for deals in every adjacent sector would push the total investment figure well beyond $8 billion. For the sake of consistency with previously published reports, this analysis focuses on U.S. companies that focus on PreK-12, postsecondary and workforce development.

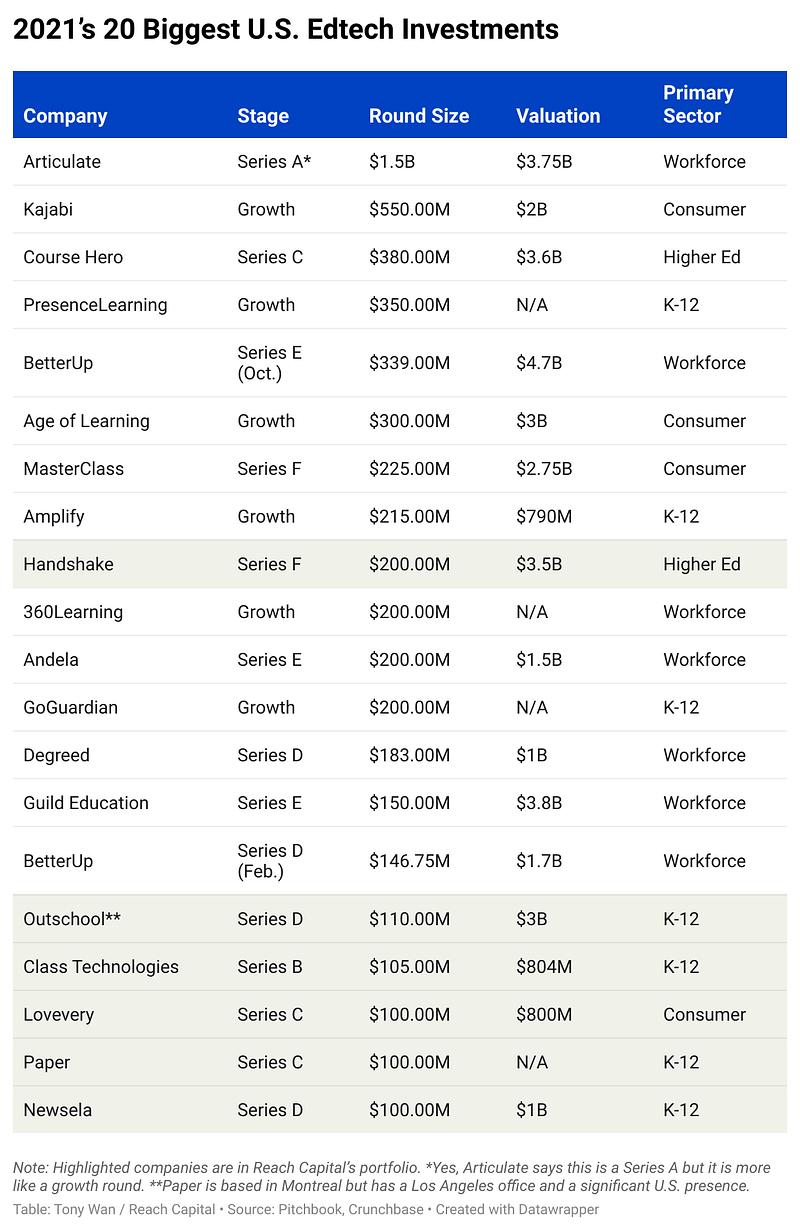

The 20 largest deals of 2021, which accounted for two-thirds of the $8.2 billion raised, were spread across all these sectors.

A few observations on key trends:

Corporate training continues to capture the lion’s share. A16z General Partner Angela Strange quipped that “every company will be a fintech company.” One could also argue that every company will be an edtech company. At a time of record-high job turnover, keeping employees feeling supported and satisfied has become top of mind for every employer.

The Great Resignation has put a premium on retaining and retraining employees and placed considerable pressure on hiring. Such are the tailwinds behind companies like Andela that train and place technical talent.

The largest deal of 2021 is a $1.5 billion investment in Articulate Global, a platform used by enterprises to create training courses for employees. (The company says this is a Series A, which is certainly an outlier in terms of deal size!) For executives and higher-ups, there was BetterUp, a coaching platform for leaders and managers that raised two rounds totalling $486 million.

K-12 and higher education are digitizing — fast (finally). The pandemic-accelerated adoption of digital tools in schools was rushed and rocky at best. But it has helped keep instruction and other critical supports going. PresenceLearning, a provider of teletherapy and other online special education related services, raised $350 million. Outschool, which helps schools offer live classes tailored to kids’ interests, raised two rounds totalling $185 million. Services like these have helped educators build comfort and confidence in the long-term value of edtech.

With addressing learning loss a top priority, districts are turning to services like Paper, which helps schools make 24/7 tutoring available to students. And at long last, digital content is cementing its hold in the curriculum market, as global demand for K-12 digital instruction and assessments is projected to double, to a $42.5-billion market, by 2025. Amplify and Newsela raised $215 million and $100 million, respectively, to expand their footprint in a space that for too long was dominated by traditional publishers.

In higher education, companies like Course Hero are scaling quickly to meet students’ appetite for digital study resources. And with traditional job fairs no longer as viable, colleges and companies are turning to Handshake to help students find meaningful careers.

The consumerization of teaching and learning. With much of learning and teaching relegated to living rooms, it’s little wonder that consumer products also enjoyed a surge in usage — and followed by investment capital. Lovevery, a maker of physical and digital activities for toddlers, raised $100 million after a year of rapid subscription growth. Age of Learning, the developer of the popular ABCmouse early learning app, scored $300 million.

For older learners, there was MasterClass, which offers celebrity-led courses that blend education and entertainment. And for creators and entrepreneurs seeking to teach and earn, there was Kajabi, a platform where they can create and sell their own online courses.

Fueling the Funding

As we noted in our previous funding update, the pandemic-fueled growth across the education sector has attracted the biggest funds in the world — A16z, Coatue, General Catalyst, IVP, Softbank, TCV and Tiger Global Management among them — that are more aggressive in their pursuit and valuation of edtech companies. This has resulted in shorter time frames, bigger checks, and more competition to get in on the hottest deals (not dissimilar to a red-hot housing market).

What’s attracting them? Simply put: more market liquidity or, in cruder terms, better bang for the buck. Before the pandemic, few edtech startups grew big or fast enough to generate home-run returns on investments. That is no longer the case after a year that saw Coursera, Duolingo, Instructure, Powerschool, Nerdy (Varsity Tutors) and Udemy go public. These six public listings in 2021 surpassed the total number of edtech IPOs during the previous decade. It is an encouraging sign that the public markets are finally warming up to the sector and valuing edtech companies like any other technology peers, at multiples consistent with their business, growth and margins.

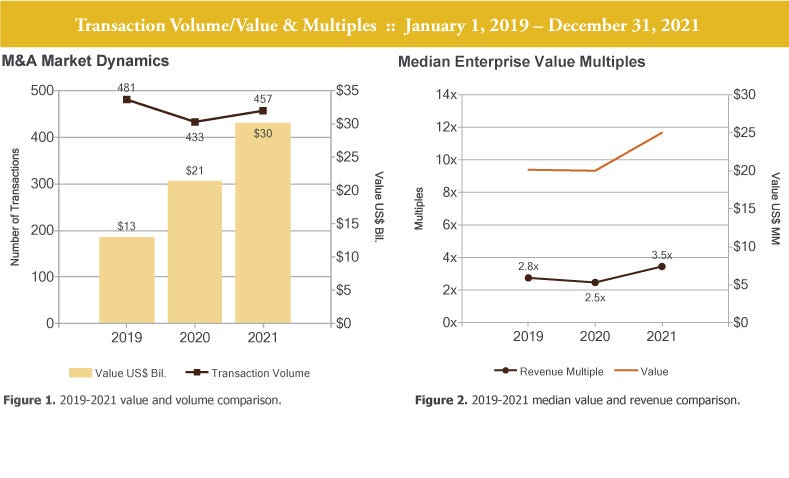

In the private markets, the education sector has also seen greater consolidation at higher valuations. According to investment bank Berkery Noyes’s analysis of education M&A activity in 2021:

- Total transaction volume increased 6 percent over 2020, from 433 to 457.

- Total transaction value rose 41 percent over 2020, from $21.36 billion to $30.22 billion.

- The median revenue multiple increased from 2.5x in 2020 to 3.5x in 2021.

One of the biggest deals was Platinum Equity’s $6.4 billion acquisition of publisher McGraw-Hill. And the most active buyer goes to India-based Byju’s, which snapped up U.S.-based Tynker and Epic! as part of a 10-count acquisition spree in 2021.

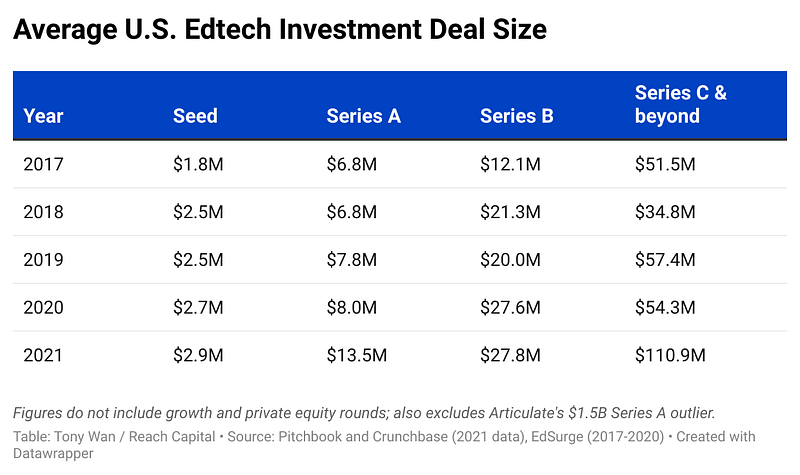

Bigger exits drive higher valuations, and the U.S. currently accounts for 15 of 33 edtech unicorns around the world, according to HolonIQ. Mega valuations tend to justify bigger deals, which is reflected in bigger check sizes across all investment stages in 2021.

What’s Next in 2022

The public markets dipped on the final day of 2021, starting a streak that has continued into this year. Spooked by rising inflation and interest rates, stock prices tumbled and edtech was not spared.

This has sparked concerns over how the disparity between public and private valuations will curb enthusiasm and investment activity, and already there are reports of investors renegotiating terms at lower valuations. Exuberance may be giving way to restraint and discipline.

Markets aside, there will be no shortages of challenges for education and the workforce this year. Declining enrollments across both public K-12 schools and higher education, compounded by dire staffing shortages, will continue to strain a system that for long has been a bedrock of society. Ongoing disruptions to childcare services will continue to put considerable stress on parents and their ability to work. Everyone’s mental health has been tested.

Not everything is necessarily dire, though. A growing remote and distributed workforce has shown that jobs can still get done outside the office. Business leaders are rethinking company cultures and environments in ways that are more flexible and attuned to people’s wellbeing. How employers adapt and innovate in this regard will be key to their ability to recruit and retain talent.

Since schools are a reflection of society, similar changes are underway in education. Technology will never fully replicate the visceral joys of in-person interactions. But it can extend the support that so many students, parents and educators need at this moment, and provide more opportunities for people to teach and learn in ways that best suit their lives.