Reach Capital’s 2020 Impact Report

The team at Reach Capital has been investing for educational impact for over 11 years. We make bold bets on founders who tackle challenges that are among the most pressing of our times, e.g. economic and education inequality, staying relevant in a rapidly-changing economy, and trauma and mental health. The global pandemic has exposed and amplified these pre-existing challenges like never before. What we believed were forward-looking bets at the time, turned into an urgent here-and-now, as demand for these solutions moved beyond early adopters to the global masses overnight.

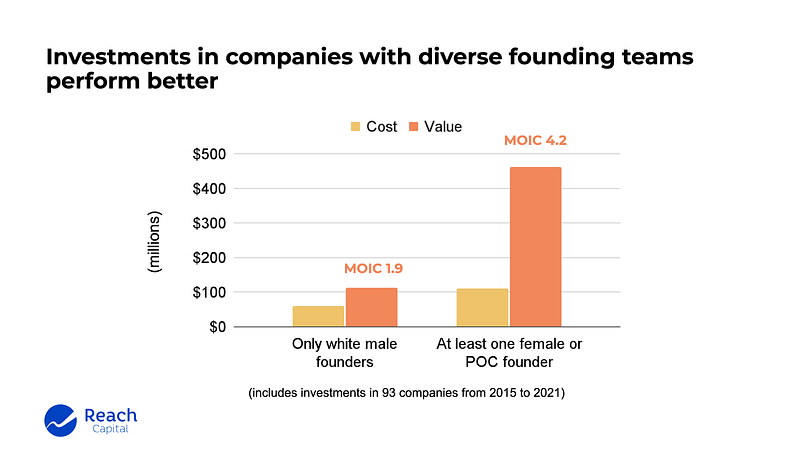

This dynamic we’re witnessing confirms why we invest for impact. We have been steadfast and arguably idealistic in our belief that investing for positive change and lifting people up can be a successful engine for capitalism. We see our approach as an antidote to companies that maximize shareholder value with a myopic indifference to the long-term impact of their practices on employees, their communities and the broader world around them. The current crisis has laid bare just how interdependent we all are. Our business decisions are a critical part of how we activate our values. We believe that capitalism does not require a trade-off between social good and financial returns.

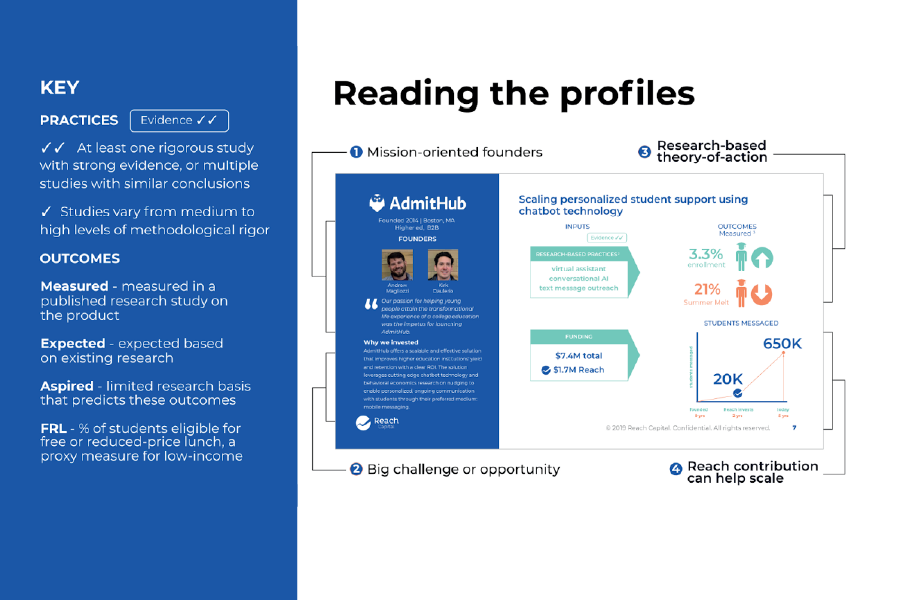

At Reach, we invest in mission-driven founders, solving important problems that they understand deeply. We invest in compelling, scalable solutions that have shown research-backed evidence of achieving their intended outcomes. When the pandemic struck, our portfolio companies had immediately deployable solutions for learning and working from home, upskilling for current and future jobs, and accessing emotional support.

With K-12 schools looking to remote and hybrid learning models for the fall, our portfolio companies offer digital libraries of kids books, online classes for kids, and on-demand access to live tutors over chat. With college students and adults navigating an uncertain economy, additional portfolio companies enable remote internships, remote connections to employers and jobs, and skills training for careers that are in high demand.

Our latest impact report highlights our investment approach and our core investments in our Reach II portfolio. Get to know our mission-driven founders, the problems they’re tackling, their innovative approaches to solving them, and progress they’ve made toward achieving their intended outcomes. We hope this can serve as a fresh take for a model of capitalism that is now gaining momentum in these tumultuous times.