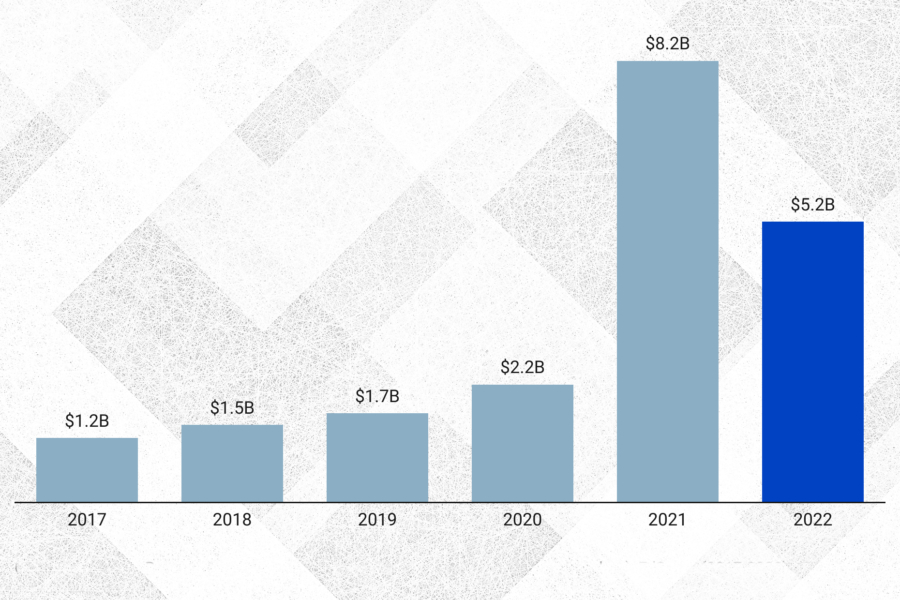

It was the bear of times, but it wasn’t the worst of times. Against macroeconomic headwinds, U.S. education technology companies still raised $5.2 billion of investment capital in 2022, according to our analysis of data from Pitchbook, Crunchbase and internal sources.

The roaring deluge of capital in 2021 gave way to a sobering 2022 that saw a pullback in company valuations and investment sentiment, amid the ongoing battle between rising inflation and interest rates. For U.S. edtech, that contributed to a 37 percent decline from the $8.2 billion raised in 2021.

To put this in context:

- Global edtech investments dropped 49 percent, according to HolonIQ. Much of this was due to the Chinese government effectively eliminating private investment in education companies.

- Overall U.S. venture capital in 2022 dropped 31 percent, from $344.7 billion to $238.3 billion, according to Pitchbook.

The fall from the highs of 2021 is a shock to the system. But taking a longer historical view, 2022’s edtech tally comfortably surpassed the totals in the years before the pandemic. Last year, edtech made up 2.1 percent of all U.S. venture investment (versus 2.5 percent in 2021), still roughly double what it used to account for over the previous decade.

It’s worth noting that investment activity skewed heavily toward the first half of the year, before federal interest rates accelerated. Two-thirds of the $5.2 billion raised in 2022, and 60 percent of deal volume, were done before July. This is likely the result of spillover exuberance from 2021 to 2022, and the fact that some deals filed in early 2022 were negotiated in late 2021.

This analysis covers companies that primarily focus on teaching, learning and increasing access to economic opportunity, across early childhood, K-12, higher ed, workforce development and lifelong learning. (The last category refers to personal development not explicitly tied to academics or work, such as language learning.) Like the broader tech and business environment, the education industry is wrestling with big challenges as people return to schools and offices. While there is a yearning for in-person experiences, other aspects of teaching, learning and working have been fundamentally transformed by digital platforms.

Still, there were megarounds at big valuations. Ten deals accounted for $1.8 billion, or over one-third, of the $5.2 billion raised overall.

Key Trends Driving These Deals

K-12 schools are looking beyond for help. K-12 schools are reeling from declining enrollments and staffing shortages, yet are also expected to provide a greater array of support to help students as they return from the pandemic. Learning loss, mental health and school safety are among the top priorities for school leaders heading into 2023.

Results from the National Assessment of Education Progress (NAEP) confirmed what everyone feared: math and reading scores fell drastically, with low-income and underrepresented students faring the worst. In response, districts are investing in tutoring services to help kids catch up, with support from federal ESSER dollars. This urgency largely fueled Paper, which provides tutoring and other educational support services to K-12 schools at no cost to students, to the top of the list.

Another K-12 company on the list, ClassDojo, is one of the most widely used apps both in the U.S. and abroad to connect schools, students and families, and is embarking to create a fun, safe and healthy virtual environment for kids that supports their social development. And as the pandemic magnified mental health issues on both young people and the educators who support them, more companies like Hazel (which raised $52 million) are emerging to help. In other areas, we are also seeing more schools partner with external parties to provide more and higher-quality student services than they are able to on their own, from therapy (through companies like PresenceLearning) to food (YayLunch) and transportation (Zum).

Higher ed eyes retention and ROI: College enrollment dipped for the third straight year since the pandemic; the crisis is particularly acute for men who dis-enrolled at seven times the rate as women. As in K-12, mental health challenges among college students are a big concern, particularly during this formative period of adolescent development.

Student retention, and by extension student support, has a top priority for higher education leaders. This is reflected in both surveys of university presidents and our analysis of 2022 deal data, where companies like Ocelot raised sizable rounds to build communication tools to connect students with campus and community resources. Mentor Collective (which raised $22 million) provides peer and career counseling for students. Stellic, one of our portfolio companies which raised $11 million last year, works with colleges to ensure that students get the support they need to graduate on time.

For many students, the ROI calculation on college still remains tied to landing a fulfilling career, particularly as tuition continues to climb on the consumer price index. To help them find these opportunities, companies like Handshake continue to raise and scale to offer a more effective alternative to the traditional job fair.

Companies are spending to get (and keep) people they want: Earlier this year, my colleague Esteban Sosnik explained how every company will be an edtech company, as no industry will be spared from accelerating digital transformations underway. When more than half of HR leaders plan to increase training budgets, it’s not surprising that investment dollars will follow. Last year, Amazon partnered with Springboard to help Amazon employees transition into high-growth fields in data analytics and software engineering. Other corporations are following suit.

Workforce training companies accounted for the biggest slice of the overall U.S. edtech funding, led by Guild Education, which connects frontline workers with certificate and degree programs offered by colleges and universities. CoachHub offers digital coaching programs for enterprise workers. Companies may be laying off employees, but they are also spending to keep the ones they want.

With employers also taking a more hands-on role to recruit and train tech talent, Multiverse raised $223M for its online apprenticeship platform that connects young people with employers for apprenticeship opportunities to build social capital and professional networks. Specific high-demand tech fields, like cybersecurity, are also beneficiaries of large investments, as evidenced by ThriveDX’s $100 million round.

Early ed: When will we pay more than lip service? For all the spotlight on the importance of early childhood — and its impact on the workforce — companies serving the smallest learners and their families somehow still get the smallest slice of the funding pie.

This market is complex and rife with challenges, which EdSurge captured best: “a faulty three-legged stool in which parents often pay more for infant care than for housing or in-state college tuition, providers squeak by on the narrowest of profit margins and the whole sad affair is balanced on the backs of a low-income workforce comprised largely by women of color.”

For all the challenges, opportunities and promising efforts abound (which is particularly encouraging for this new parent). Many of the companies that raised in this sector offer to help connect families with providers, such as Kinside and WeeCare, which both raised $12 million Series A rounds. The biggest deals went to SaaS providers Brightwheel ($50 million Series C) and Kangarootime ($26 million Series B), which both develop communication and operations software to help childcare providers run their businesses. And in recognition of the challenges of childrearing in a pandemic, Little Otter raised $22 million to provide mental health and therapy support to young children and their parents.

Valuations and the Road Ahead

The shuttering of the IPO market, coupled with slashes in private company valuations, certainly had a chilling effect on investments. But not all funding stages were affected equally. The blows to round sizes and valuations have been softer in early-stage deals, according to Pitchbook and Cooley, the most active law firm for VC financings. It’s the later-stage deals where figures have declined the most, as the mega rounds of 2021 appear to be on pause.

That is largely consistent with our analysis of average round sizes and post-money valuations for U.S. edtech deals. In the table below, restricted our 2022 analysis to deals done in the second half of the year. This was when market headwinds came into full, discounts early 2022 deals that may have been negotiated in 2021, and may be more reflective of investor sentiment in 2023.

Lean times are never fun. But while the sky-high valuations that defined 2021 fundraising may be on hiatus, investors are sitting on a record amount of dry powder, replenished with new capital from big incumbent firms and new solo funds. There will be plenty of opportunities in the pipeline. Already we have seen a new wave of AI tools fueled by new “generative” models and ChatGPT that have taken schools and startups by storm. Many are being built by first-time founders. If there is a silver lining to all the layoffs happening, it is that new startups often spring from the ashes.

Longtime edtech entrepreneurs and investors remember well the days of scarce capital, when the industry was largely an afterthought. Yet many leading global education companies today — Chegg, Coursera, Course Hero, Desmos, Duolingo, Nearpod, Udemy — were founded during 2006 to 2012, around the Great Recession.

Times have changed as the edtech market has since established itself as a rewarding powerhouse, from both a financial and impact standpoint. It is no longer a niche industry, and those that are resilient and grow in the face of constraints will be well-positioned to be the market leaders of the future.