by Esteban Sosnik, General Partner at Reach Capital

For too many years, anyone who has tried raising capital in edtech has faced skeptical investors who cite similar reasons for their reluctance: past investments were underwhelming. Up to 2020, few startups have scaled fast or big enough to generate fund-return exits. And the ones that have gone public were trading at multiples lower than other tech companies.

Those concerns were not unjustified. While massive in size, the education industry has been slow to digitize. Before COVID-19, digital spending accounted for just 3 percent of all education spending. Education is also a broad, complex market with many subsectors, each with different kinds of users, payers and business models. The result was an underinvestment in edtech, which accounted for just about 1 percent of all venture capital invested in the U.S.

But just as it has done across every industry, the pandemic upended traditional norms in education and significantly accelerated its digital transformation. It is now commonplace for students to be learning remotely and leveraging digital technology to access quality content and teachers. New platforms are allowing schools to reimagine education by tapping a global labor force eager to share their passions and experiences with others.

The markets are responding accordingly. Today’s edtech companies are getting an unprecedented amount of capital and high valuations, leading to record high investments and new unicorns being minted every few weeks. As venture capital continues to seek out large sectors still early in their technological transformation, education has become far more attractive. Without doubt, this is a super exciting (and overdue) moment for the industry.

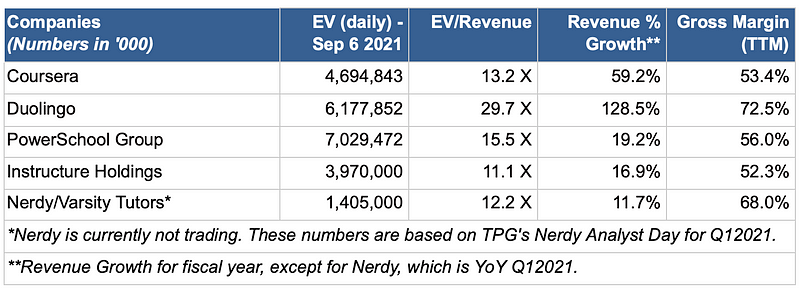

Even more importantly, the public market is now valuing edtech companies like other tech companies. In a year that has already seen four edtech companies go public (with a fifth on its way), the public is finally warming up. This new crop of education leaders are trading at multiples consistent with their business model, growth and gross margin. There is no “edtech” discount in their valuations.

Suffice to say, investors are recognizing that education presents huge opportunities for startups and are excited about its potential

*Nerdy is currently not trading. These numbers are based on TPG’s Nerdy Analyst Day for Q12021.

**Revenue Growth for fiscal year, except for Nerdy, which is YoY Q12021.

Our analysis of the newly-minted publicly traded edtech companies finds their stocks trading at multiples similar to their peers in any other industry. Underlying these multiples are factors unique to each company:

Coursera

- Even though Coursera started as a direct-to-consumer company offering courses to individuals, it is being traded at 13X revenue, more like an enterprise SaaS than a consumer company. Their enterprise channel, which sells to universities and companies, already represents 25% of their revenues and is growing by 2X, so this could be sending the message to investors that growth will be more skewed to B2B.

- Also, the multiples are probably likely affected by their gross margins (53%) which are more in line with services-heavy software businesses.

Duolingo

- Duolingo currently trades at almost 30X TTM revenue (and 20X forward looking revenue) which is much in line with high growth consumer companies, such as Fiverr. As a matter of fact, many leading consumer companies like Netflix (the leading consumer subscription business) trades closer to 10x revenue and Spotify closer to 5x, as do other peers in the freemium model like Match and Bumble.

- Their revenue growth is significant (100%) and it’s already working on other subjects, expanding its TAM. According to Apptopia, the popular language-learning app is acquiring users faster than its three closest competitors combined.

- It has great margins (70%) that has steered the company toward profitability. It is a company that has been quite capital efficient, having raised north of $180 million prior to their IPO, and are already operating close to cash break-even.

- There is plenty of opportunity to further convert Duolingo’s large user base of 500 million users and 40 million monthly active users into paying customers. (There are currently about 1.8 million paying subscribers)

Powerschool & Instructure

- Both PowerSchool and Instructure trade at 11–15X revenue, which is in line with SaaS comparables. The median of the Bessemer Enterprise Cloud is at 16X and 13X forward-looking revenue. In fact, 11X is higher than well recognized SaaS companies like Dropbox, Box and New Relic.

- Their multiple at +10X is impressive given their sub 20% growth and 50% gross margins.

- Both companies, which sell to K-12 schools and colleges, are expected to benefit from market tailwinds. For example, U.S. K-12 IT spending is expected to grow 9% CAGR and higher-ed at 10.3% post COVID.

How times have changed. The five U.S. edtech IPOs in 2021 alone (counting Nerdy’s forthcoming listing) eclipse just four that happened in the previous decade. Prior to the pandemic, no U.S. edtech company (public or private) had achieved a valuation surpassing $5 billion and, except Chegg, the rest were under $2 billion.

The timing and the tailwinds are clear: “edtech” is no longer a niche investor category. Companies and founders will be evaluated less by the shadows of the past, and valued according to their ability to execute and deliver on a massive global opportunity. Like the private market, public investors are jumping onboard with enthusiasm for companies pursuing different education subsectors and business models. At Reach Capital, we have been investing and supporting amazing founders in this incredible industry for more than a decade, and are now excited to see investors of all asset classes join us in their enthusiasm. This is very good news for edtech founders, operators and investors.

Thanks to the team at Barclays (Peter Bulandr and Alex Pavlovich), for providing their insights and reports for this post and to Enzo Cavalie for the great analysis of the data