Shortly after the country went on lockdown last March, I welcomed my first child. Being a new parent was, of course, a life-changing event. But it was hard for me to disentangle what changes were specific to COVID, and what came naturally with parenthood.

What was noticeable was how much of our village of support was digital. It was an incredibly isolating time to be a new parent, but we adapted. My hospital birth and newborn care classes were all delivered via Zoom. Grandma and Grandpa beamed in over Skype, the midwife checked in over FaceTime, and my fellow pandemic mamas shared milestones and countless questions in WhatsApp groups.

Those moments showed how technology can help parents navigate the joys and mysteries of birth and parenthood. Far from being temporary substitutes for in-person interactions, these experiences are evidence of the many ways in which digital tools and services can better support future generations of newborns and new parents.

With research linking early childhood education to cognitive development, academic readiness and career earnings, there are few other sectors that can deliver such a life-changing “return on investment.” Child care also affects adults whose availability for school or work often hinges on whether there is someone to care for their children. The labor market and economic implications are clear: Last year, as schools shuttered, more than one-fifth of parents were unable to fully return to work as they stayed home to provide care.

This is why we believe investing in early childhood education is about investing in the future of families.

The Early Childhood Market Is Growing Up

At Reach Capital, we believe in supporting modern, inclusive solutions that empower families and caregivers as their child’s very first educator. It is about technology that enables meaningful connections and active play, which are critical to early learning and development.

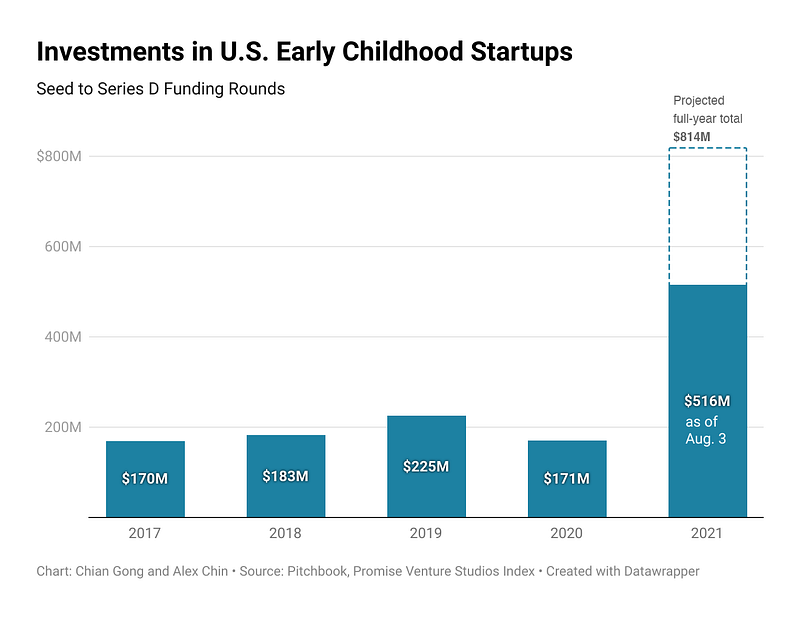

Investment activity in this sector has been growing steadily before a temporary pause in 2020 due to the market uncertainties posed by COVID. And while the overall dollars are small relative to other education technology sectors, momentum is picking up this year with an unprecedented $516 million invested as of early August — nearly the same amount as the previous three years combined.

The growing investment reflects the enormous market opportunity in a category ripe for innovation. In 2019, families across the globe spent an estimated $246 billion on early childhood services, a figure that is projected to reach $480 billion by 2026. A growing portion of that spend is going digital: Forbes estimates that the “new mom economy,” which covers apps, gadgets and services for first-time parents of children under the age of one, is a $46 billion market.

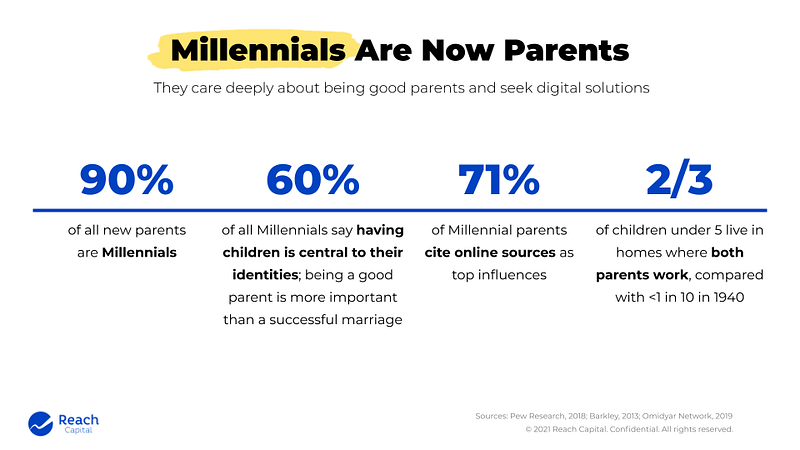

Driving this market are demographic and cultural shifts. Ninety percent of new parents are Millennials who grew up with the internet and default to searching online for support. And unlike previous generations where it was more likely that one parent stayed at home to raise the kids, today more than two-thirds of children under 5 live in homes where all parents work. In 1940, this rate was less than 10 percent.

With more and more parents in the workforce, demand for quality child care has far outstripped supply. That has led to fewer spots at centers and daycares — and rising costs. Federal data shows that the cost of child care and nursery school has increased at roughly twice the pace of inflation since the turn of the century.

Before the pandemic, two-thirds of families said they had a hard time finding affordable, quality care. When COVID struck, supply shrunk even further as 11 percent of child care centers closed permanently, and 80 percent either closed temporarily or were forced to operate in a more limited capacity.

Unlike schools and colleges, most child care providers could not shift to remote learning. Most were operating on very thin margins to begin with, and the pandemic pushed them over the edge. And given the paltry wages for child care workers ($12.88 per hour), it’s little wonder that more than two-thirds of providers say recruiting and retaining staff is more difficult now than it was before the pandemic.

Federal funds, like the recent child care tax credits, will help many families and providers get back on their feet. And increasingly, employers are recognizing the importance of providing child care support for their workforce. A recent report noted that 42 percent of employers plan to expand or add care as a benefit.

Still, the pandemic has highlighted major gaps in child care and early education that need more support, and is a wake-up call to make these critical services more affordable and sustainable for families and early educators.

A Bright Future for Early Childhood

Technology can help scale quality care and dramatically reduce costs for families, and we see exciting opportunities in the following categories within early childhood and family tech:

New Care Models

Child care centers are typically associated with center-based programs run by the likes of Bright Horizons, Head Start or KinderCare, which altogether enroll approximately one in four children. Bright Horizons, a $9-billion publicly traded company, operates over 1,000 locations across the country. That sounds big, but it has captured just 1.6 percent of the market. This category is ripe for new models and represents a $136 billion opportunity.

Demand for care far outstrips supply, with just 10 million licensed spots available in a nation that has over 23 million children under five. As a result, the landscape of child care providers is incredibly fragmented. More than half of all children under four are in informal care settings with family members or neighbors. Companies like Otter and Nanno are working to bring these informal care networks of stay-at-home parents and sitters online. I’m thrilled to see more recognition (and pay!) go to the village of care that supports each family.

Within our portfolio, Winnie, a marketplace that helps families find and vet quality care, is seeing unprecedented demand for flexible, part-time or drop-in care options. Demand for flexible care was growing even before the pandemic and will remain robust as childcare needs have fundamentally changed with the rise of remote work. In response, new early learning programs such as TinyCare, Vivvi and Brella leverage technology to offer a digital-first user experience and greater flexibility in terms of locations (near home and work), employer partnerships, and available hours.

In-home care providers are especially critical for families that need more flexible hours for school or work and who need care for infants and toddlers. These programs have been on the decline for the past decade due to rising costs, low compensation and operational complexities. But there is renewed interest and investment in this sector, thanks to a wave of new innovators such as MyVillage, Wonderschool, WeeCare, Neighborschools and Weekdays that help providers navigate the regulatory process, access better benefits, and offer ongoing support.

Daycare/Preschool Software

Driving the operations of these new care models are software providers that handle day-to-day tasks, including registration, payments, curriculum and communications between caregivers and family members. There are many unique processes, documentation and requirements to running a day care program, and specifically tailored software can help providers reduce overhead costs and save time on paperwork.

The largest player in this category is Brightwheel, which just raised $55 million earlier this year. They, along with companies like KangarooTime and HiMama, offer a suite of back-office tools to help providers run their programs more efficiently. In our portfolio, Kaymbu places an emphasis on the teacher and family-facing experience with assessment, instructional planning, family engagement and professional development.

Adoption of these tools accelerated last year as previously offline programs had to navigate communicating and operating safely in a pandemic. Demand has been driven both by a “push” to improve operating efficiencies, and also a “pull” from parents who are accustomed to a more digitized experience and real-time updates that they get from Instagram, Slack and other digital platforms they use every day.

Parent Support & Education

This generation of parents are digital natives and seek support online. Similar to the growth of the telehealth industry, learning opportunities that were previously offline — such as birth classes, doulas, lactation consultants, “Mommy & Me” classes — are now available online thanks to digital marketplaces like Robyn and WellNested (just acquired by Mombox), which connect parents with experts. Other companies, like Tinyhood, Kinedu and BabySparks offer expert content and classes on demand for everything from breastfeeding to baby sign language.

Employers are recognizing the importance of supporting young families, which is the tailwind behind companies like Cleo and Maven. These companies provide 1:1 coaching and support to expecting and new parents.

Building on the coaching model, our portfolio company, Guardians Collective, offers expert-led parenting circles. They help make parenting less isolating and more collaborative by offering a safe, educator-led space to explore each step on the parenting journey. Other innovators focused on small-group support include Seven Starling and Oath Care, both focused on connecting families from pregnancy through pediatrics.

Home Learning

Most young children are not in formal early learning settings. To serve all children, we’re eager to invest in the next generation of content, tools and services that inspire learning in the home or other informal care environments.

There is a lot of guilt and judgement around screen time for young children, and the pandemic has certainly accelerated their time on devices. But just as Big Bird and his furry friends were pioneers in using television as an educational medium, we can create a next-gen Sesame Street that harnesses the power of digital technology for early learning.

There is evidence that Zooming with grandparents and other real-time video interactions offer valuable social-emotional learning benefits, even for very young babies. This is encouraging for companies like Caribu, which helps kids read and play with parents and grandparents through video, and Beanstalk, which designs live, interactive classes for preschoolers.

Beyond screens, companies like Tinkergarten and Lovevery offer tech-enabled physical experiences that help parents access high quality early learning opportunities and empower them to be a child’s very first educator. Tinkergarten helps parents find outdoor learning activities in their communities; Lovevery provides curated play kits and resources to create delightful developmental experiences for families.

Coming out of this pandemic, the world has changed for parents, employers, and providers. We have a once-in-a-lifetime opportunity to create a more connected, empowered, and supported generation of parents by investing in the future of families.

If you’re building for the future of families I’d love to hear from you! Reach out at chian@reachcapital.com.