Last month I attended the Founder’s Commitment Version 2.0 Launch Event at the Kapor Center for Social Impact. As I sat in the audience and listened to entrepreneurs (many in my own portfolio) discuss building diverse and inclusive organizations, I reflected on my own organization. How diverse is the Reach portfolio? Are we doing enough to build a diverse portfolio of founders at Reach? If not, what should we be doing? [ SP ]

After digging into our data, we realized that our portfolio still has a long way to go. If our portfolio is to reflect the diversity of our educational system and our country, we need to be more intentional across our organization to achieve this diversity.

In a blog post titled Dear Investors: So You Want to Take Diversity Seriously (Part 1), Mitch and Freada Kapor suggested:

“The most effective method to build a diverse portfolio is to make it a priority to increase the diversity of your own firm.”

We wholeheartedly agree and have intentionally built a diverse team at Reach that contrasts sharply with industry averages in VC where 98% of VCs on senior investment teams are white or asian males. Our Reach team is small, but diverse with a majority women and a majority people of color. Our team includes immigrants and children of immigrants and educators who have worked directly in public schools — with first hand experience of the challenges that students and families in poverty have faced. We value our team’s diversity as a strength and a differentiator for our fund. Our diverse team yields a broader network for sourcing and perhaps most importantly, it helps us better identify and understand entrepreneurs working to solve problems within these communities. However, our diverse team is only Step 1 — as we have found, having a diverse team does not necessarily result in a diverse portfolio of founders.

To better understand the challenge and determine next steps, we dug into the numbers.

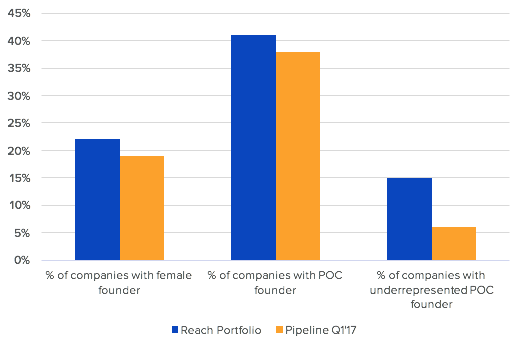

We first looked at the diversity in our current portfolio and compared it to industry averages. We included the dimensions of gender, people of color (POC), and people of color from underrepresented backgrounds (Black or Latinx).

Industry-wide benchmarks are sparse, but from what we’ve found, the Reach portfolio is notably more diverse. According to the latest study from crunchbase, only 17% of all venture-backed companies have a female founder, Reach is slightly higher with 22%. Data on racial diversity is more limited, but CB Insights states that only 17% of all seed and Series A venture-backed companies have a POC founder — which implies that Reach’s portfolio (with 41% of companies) is actually more than double the industry average. That said, we still have a long way to go, particularly in an industry vertical that serves a very diverse set of users. 76% of educators in US K-12 education are female, and 52.1% of US K-12 students are estimated to be students of color.

We reviewed our pipeline since it is the most commonly cited obstacle to investment diversity, and here is what we found:

Diversity of Reach Portfolio vs. Q1’17 Pipeline

While our portfolio is slightly more diverse than our pipeline, both are still severely lacking entrepreneurs from underrepresented backgrounds. Our portfolio currently has zero African-American founders, while 15.1% of the K-12 student population is African-American. This is a pervasive problem in the venture community — there is a dearth of funding for diverse founders. Female founders received just 8% of the $60B of venture funding in 2016 and black male founders received a scant 2%.

Given that our portfolio’s diversity is proportional to (if not slightly more diverse than) our pipeline, one key step to diversifying our portfolio is to be more intentional in sourcing our incoming pipeline. The majority of our current pipeline comes from investor and founder referrals within our network, and these people by and large are not from diverse backgrounds. Going beyond our direct network to intentionally source from other geographies, accelerators, and investors dedicated to diversity (e.g. Kapor Capital) is a key first step. While we are open to all referrals and have an online submission form, we need to build more awareness of our Fund in communities outside Silicon Valley.

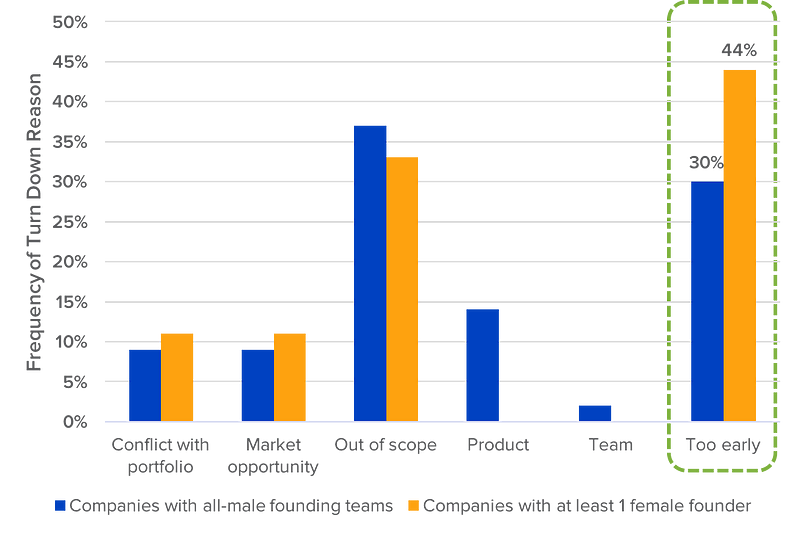

In addition to expanding our pipeline, we reviewed our pipeline data to look for any patterns in why we turned down founders from diverse backgrounds. Some interesting patterns emerged:

Turn Down Reasons vs. Founding Team Gender Diversity

Turn Down Reasons vs. Founding Team Diversity

Note: the sample size here is quite small as we had only a handful of underrepresented POC founders in our Q1’17 pipeline.

We tend to disproportionately turn down both females and underrepresented POCs for being “too early.” This reason is often used when we feel companies haven’t met certain metrics or milestones for an institutional seed investment.

One possible interpretation is that these companies are in fact earlier because they don’t have access to angel/pre-seed capital or have high net worth “friends and family.” Less than 10% of all venture capital deals go to women, POC, and LGBT founders, and this is likely more pronounced at the friends and family stage. A few programs like the 4.0 schools Tiny Fellowship, Better Ventures PreSeed and CamelBack Ventures are hoping to help fill this void, but more is needed. Another step we could take is to better connect these founders with angel/pre-seed capital as well as catalyze additional angel/pre-seed capital for companies at this stage.

Another interpretation is that our team has unconscious bias in our investment decision making process. Are we consistently applying the same metrics or are we holding women and underrepresented people of color to a higher standard? Furthermore, are we willing to take more risk on someone who looks a certain way with a certain background? Now that we have a rich data set, we can better standardize our metrics. For example, we recently had a conversation about what it means to be a “scrappy” founder which is one of our criteria. Does scrappy for a 21 year old white male look different than scrappy for a 45 year old Black woman? Yes, and if so can we tell the difference? Thus, another step is to identify potential bias in our decision making and take steps to mitigate it.

These are just a few of our observations and steps we are taking to more intentionally build a diverse portfolio. But remember, step 1 is diversifying your team, so start there, but don’t stop there!

If you are unsure of how to start this process, try taking inventory of your organization today and benchmarking your team against comparable organizations (as well as the communities your portfolio serves). This reflection sets you up to have more conversations as a team on the right steps moving forward — How can the team diversify pipeline deal flow? What are the criteria with which the team evaluates founders? What potential biases do these criteria have?

For entrepreneurs looking for resources on how to foster diversity & inclusion in their companies, we’ve found these resources from Project Include and TechStars as well as this blog post from Abl’s Adam Pisoni to be helpful jumping points.

Special thanks to our GSB Impact Lab Associate Christina Martinez for her help in analyzing the data and collecting benchmarks. Also thank you to the Reach Team, especially Kushal Amin, Jennifer Carolan, Jim Lobdell, and Jennifer Wu for reviewing and providing feedback. Last, but not least, our thanks to Ellen Pao and Freada Kapor for helping to spark this dialog and for their thoughtful feedback on this post.